Sale Of Term Life Insurance Policy Tax Consequences

Revenue Ruling 2009-14 Ruling 2009-14 addresses the income-tax consequences to the purchaser of a term life insurance policy upon later maturity of the contract or sale. Memo 2014-27 that explains what the income tax consequences are when this situation occurs.

How To Rescue A Life Insurance Policy With A Loan Life Insurance Policy Life Insurance Companies Insurance Policy

Specifically the acquirer has no substantial family business or financial relationship with the insured apart from the acquirers interest in such life insurance.

Sale of term life insurance policy tax consequences. Capital Gains Remaining proceeds are taxed as capital gains. Death proceeds paid will be taxable income to the life settlement company to the extent they exceed the purchase price of the policy plus any future premiums paid. Based on the IRS Guidelines if a term life insurance policy is sold then 100 of the life settlement proceeds should be treated as a capital gain.

The policy gain is equal to the proceeds of disposition minus the adjusted cost basis ACB of the interest in the life insurance policy. For the year to 31 October 2018 the value of the parts surrendered was 1500. In two specific circumstances often referred to as a viatical settlement meaning the sale of a life insurance policy by someone who is chronically or terminally ill cash from selling.

A life settlement is the term the financial services industry uses for what the Internal Revenue Code calls the commercial transfer ie sale of a life insurance policy term or permanent to a third party an acquirer who has no insurable interest in the insureds life. Taxable life settlement transactions However if you sell your life insurance policy early the sale proceeds are generally taxable income just like the sale of any other asset. This gain is fully taxable as ordinary income.

If you transfer a life insurance policy to a beneficiary tax authorities regard the transaction as a gift. However the gift tax wont have to be paid until your death. This is because the sale of the life insurance policy under these circumstances is treated as in part the sale of a pure insurance asset resulting in ordinary income and as in part the sale of an investment asset resulting in capital gain.

In Revenue Ruling 2009-13 the IRS addressed the income tax consequences of both surrendering a policy back to the insurer and selling it to an investor group. A life insurance policy transfer may trigger a policy gain which is taxable in the ha nds of the transferor. One of the primary upsides to life insurance is that the payout is made to your beneficiaries tax-free.

In the opinion the taxpayer had been the owner of a whole life insurance policy for over twenty years. If the policy holder sells a life insurance policy on the life settlement market the life settlement taxation consequences are more complicated. In the 4 earlier years.

It should be noted that life insurance policies do not fall into the tax category of. Since life insurance death benefits can be in the millions of dollars its a significant. Term Policy Death Benefit of 500000 Individual sells policy for a settlement amount of 70000 Premiums paid into policy of 15000.

Tax in respect of a disposition. Yes in case you surrender or terminate your life insurance policy. Under current gift tax rules if you transfer a policy with a present value of more than 15000 to another person gift taxes will be assessed.

Though you can give up your policy is there any tax implication which you should know. Any gain from the sale of a life insurance policy you own will be subject to income tax. If convertible most Term life insurance policies may be sold for lump-sum of cash as a Life Settlement if the Insured may live up to 23 more years or as a tax-free Viatical Settlement if the Insured will probably live 2 years or less per medical certification.

A sale of a policy to a life settlement company on the secondary market. However many times than not you want to give up your policy before its stipulated tenure. The policy had both.

While life insurance can be an income tax-free asset when structured appropriately the income tax laws may result in the transfer of life insurance policies that are income taxable to both the transferor and the transferee. Commissioner of Internal Revenue TC. This article will discuss how life settlements are taxed how the TCJA affects life settlements and what you can expect to pay in taxes if you complete a life settlement option.

This may be particularly important when life insurance policies are owned by businesses and may be distributed out of the business at some point. The life insurance policy was taken out on 1 November 2013 with a single premium of 10000. The policy is intangible and pays a benefit either in case of maturity or death during the term of the plan.

Another important aspect. A life insurance policy is a long term contract. Contact your BSMG Life Advisor when you have an existing policy that needs to be transferred to a new owner.

Fortunately the tax consequences of selling your life insurance have become simpler with the new Tax Cuts and Jobs Act of 2017 TCJA. The United States Tax Court just handed down a decision in Black v. Like the sale of most other assets the difference between the amount you receive from the.

You buy the policy with a term ranging anywhere from 5 years to 35 years.

Types Of Life Insurance Universal Life Insurance Term Life Life Insurance Types

Why Term Life Insurance Is Better Than Whole Life Insurance

Sell Life Insurance Policy Selling A Life Insurance Policy For Cash Payout

Are Life Insurance Proceeds Taxable Cases In Which Life Insurance Is Taxed Valuepenguin

The Keys To Mortgage Life Insurance Forbes Advisor

Understanding Universal Life Insurance Forbes Advisor

Miplanforlife Miplan Https Www Facebook Com Miplanforlife Life Insurance Facts Life Insurance Insurance Marketing

Converting Term Life Insurance To Permanent Life Insurance

Www Buylic In Life Insurance Marketing Ideas Life Insurance Sales Life Insurance Marketing

Is Life Insurance Taxable Forbes Advisor

Blog Caraker Law Firm P C Life Insurance Quotes Life Insurance Facts Life Insurance Companies

Twitter Universal Life Insurance Term Life Life Insurance Types

Can A Nursing Home Take Your Life Insurance Fidelity Life

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Understanding Taxes On Life Insurance Premiums

Tax On Insurance Do Beneficiaries Pay Taxes On Life Insurance Aegon Lifeaegon Life Blog Read All About Insurance Investing

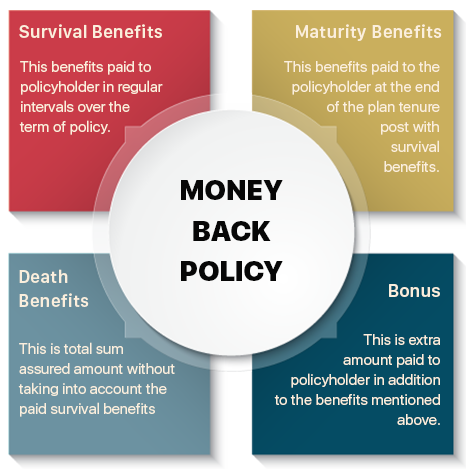

Money Back Policy Compare Money Back Plans Features Reviews

Life Insurance Companies May Sell Indemnity Based Health Plans Again The Financial Express

:max_bytes(150000):strip_icc()/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Post a Comment for "Sale Of Term Life Insurance Policy Tax Consequences"