S-corp Vs. Llc Health Insurance Deduction

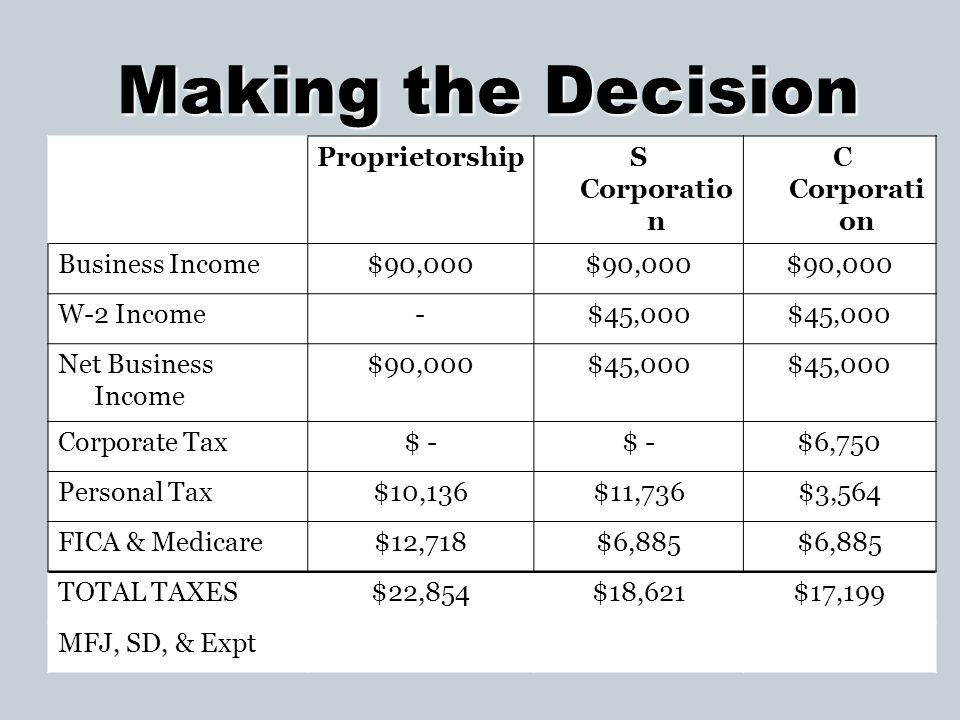

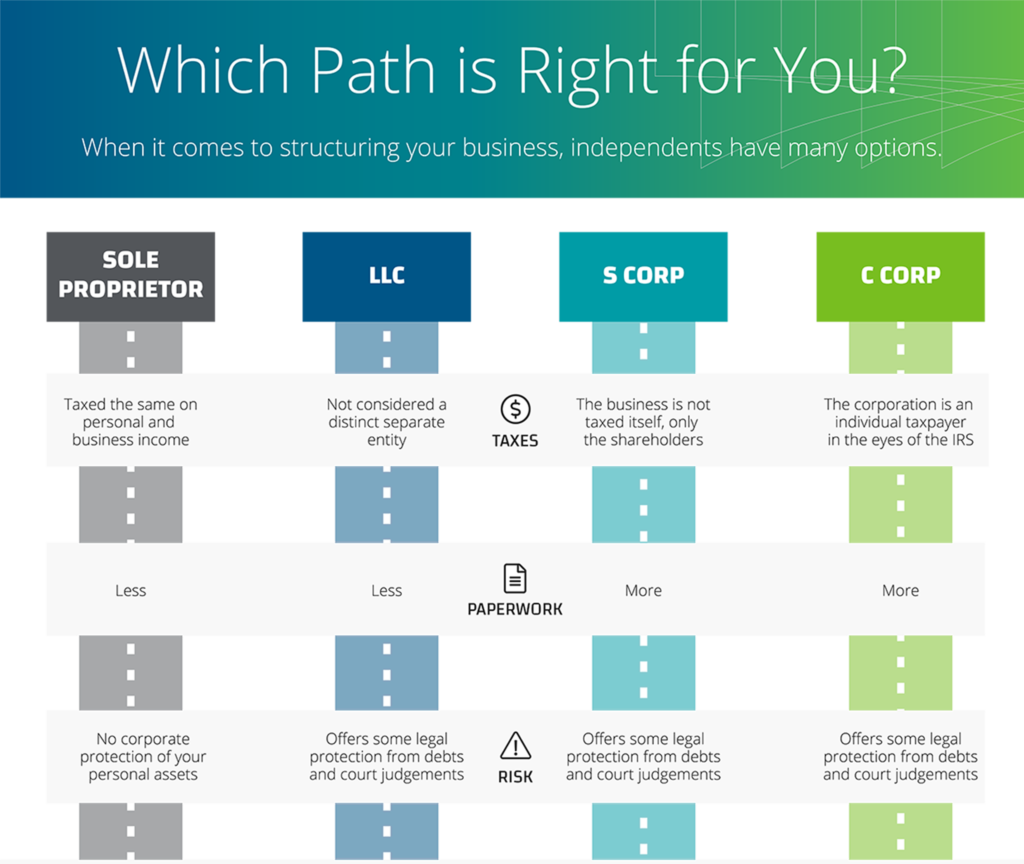

Getting a health insurance LLC deduction depends on whether the deduction is being taken out for non-member employees or members of the LLC as well as the legal and tax status of the LLC and whether the LLC is classified as a sole proprietorship partnership or corporation. In contrast health insurance paid by an S Corporation for a more than 2 shareholder is not deductible by the corporation.

Entity Selection S Corp Vs Llc Tax Analysis

If you are a greater than 2 shareholder in an S corporation you can receive a tax deduction for the health insurance premiums paid on your behalf by the S corporation.

S-corp vs. llc health insurance deduction. Similarly if the shareholder purchased the health insurance in his own name but the S corporation either directly paid for the health insurance or reimbursed the shareholder for the health insurance and also included the premium payment in the shareholders W-2 the shareholder would be allowed an above-the-line deduction. Nevertheless the S corporation owner will qualify for a tax-favored self-employed health insurance deduction on their personal tax return by including the health insurance premiums paid by the corporation as taxable wages. Self-employed people are allowed to deduct health insurance premiums including dental and long-term care coverage for themselves their spouses and their dependents.

S-corp owners may not have the same access to tax-free health insurance as non-owner employees but they can still ensure their premiums are tax-advantaged. In order for a business owner to be eligible to participate in an. Specifically the shareholder can now deduct the insurance premiums as an above the line deduction on Line 29 of Form 1040.

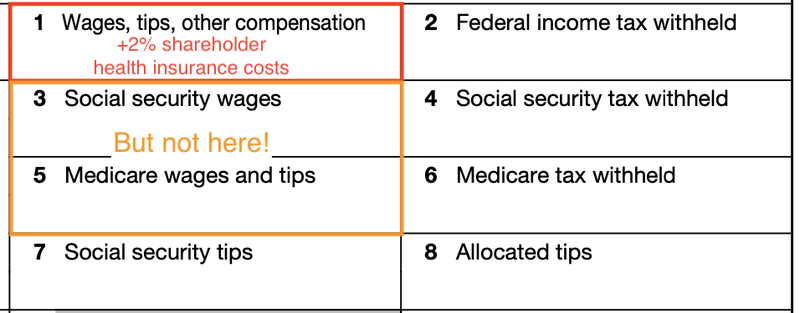

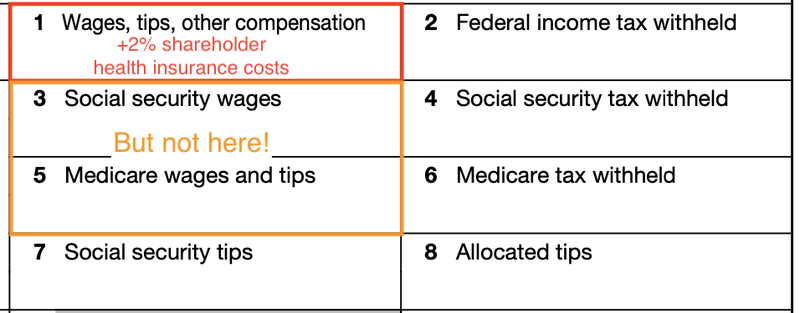

Self-Employed individuals can already deduct some health insurance expenses without an HRA. While an S corp has pass through taxation like many other forms of tax elections in respect to health insurance premiums the law gets more complex. In income as accident and health insurance such payments are not wages for FICA Social Security and Medicare tax purposes.

The amounts that you pay on behalf of your employees can be claimed on the employers income tax return. Fringe benefits such as employer provided vehicles and public transportation passes are also deductible. Unfortunately even though there are many benefits to owning your own S Corporation getting tax-free health insurance for yourself is not one of them.

The shareholder must generally take a self-employed health insurance deduction on his personal return. If an LLC instead of accepting the default IRS tax classification elects to be taxed as an S corporation any member who owns at least a 2 percent share of the LLC and receives a wage from the company is also eligible to deduct up to 100 percent of health insurance premiums. Second even though the owner does not get tax-free fringe benefits from corporate-paid health insurance the owner wants the S corporation to pay for the insurance.

Specifically S-corp owners can take a personal income tax deduction on the health insurance premiums paid by the business. Previously established by the S corporation meant that the medical care coverage had to be in the name of the S corporation. First if the S corporation pays the cost of health insurance to cover the owner the owner does not get this coverage as a tax-free fringe benefit.

Taking the deduction is simple but the reporting obligation is quite tricky. When it comes to determining whether or not business owners are eligible heres a good rule to follow. Again you claim the deduction on your individual tax return.

If you own more than 2 of your business on any given day of the year and your business pays for your health insurance then the money paid for your insurance is considered taxable income. Health insurance tax deductions. For you a 2 or more S corp shareholder the Affordable Care Act ACA doesnt affect how you deduct your S corp-provided health insurance benefits.

Lets assume you are an LLC that filed to elect S corporation status and you own 100 percent of. If you are a shareholder in an LLC taxed as an S corporation you can deduct health insurance premiums as long as you own at least 2 percent of the companys shares and receive a salary from the company. Health Insurance Employee Benefit for a S Corporation One drawback to the S corporation is that employeeowners cannot deduct the cost of health insurance from taxes.

11 Personal Deduction for Owner S Corporation owners may deduct eligible premiums for accident and health insurance including LTCI premiums that the S Corporation pays for them their spouses and other eligible dependents. It is one of the benefits of establishing a business as a C corporation rather than the other choices available to business owners which include sole. C corporation health insurance deductions can be taken for health plan premiums paid for shareholders employees and their families no matter how large or small the corporation may be.

Its possible to claim the health insurance you pay as a tax write-off. We strongly recommend S-Corp owners talk to their licensed tax professional or CPA. A 2-percent shareholder-employee is eligible for an AGI deduction for amounts paid during the year for medical care premiums if the medical care coverage is established by the S corporation.

For S-corp owners to qualify for the deduction their health. You need to attach Form 8941- Credit for Small Employer Health Insurance Premiums. When youre an S corporation owner with more than 2 of the company stock youre treated the same as a self-employed person when it comes to deducting health insurance premiums.

S Corp A Comprehensive Guide To Filing Taxes

A Beginner S Guide To S Corp Health Insurance The Blueprint

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Independent Contractor Physician Llc Or S Corp Apollomd

I Own An S Corp How Do I Get Paid Clearpath Advisors

Llc Vs S Corp What S The Difference Truic

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Choice Of Business Entity Ppt Download

A Beginner S Guide To S Corp Health Insurance The Blueprint

How To Deduct Shareholder Health Insurance For S Corporations Amy Northard Cpa The Accountant For Creatives S Corporation Health Insurance Small Business Finance

How To Choose The Best Legal Structure For My Business Mbo Partners

Llc Vs Corp The Decision New Businesses Face Probooks Ny

S Corp Vs C Corp Which Is Right For Your Small Business The Blueprint

All You Need To Know About S Corp Health Insurance Blue Lion

S Corporations Learn 15 Advantages Disadvantages Corporate Direct

Llc Vs S Corp What S The Difference Truic

S Corp Election Self Employment S Corporation Taxes Wcg Cpas

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Post a Comment for "S-corp Vs. Llc Health Insurance Deduction"