Reporting S Corp Owners Health Insurance On W2

S CORPORATION OWNERS HEALTH INSURANCE HEALTH SAVINGS ACCOUNTS HSA REPORTING Self-employed taxpayers are allowed an above the line deduction a deduction directly from gross income for 100 of the cost of providing medical and dental insurance for themselves and their families. S-Corp to include the health insurance premiums on Form 1120S Line 7 Officer compensation.

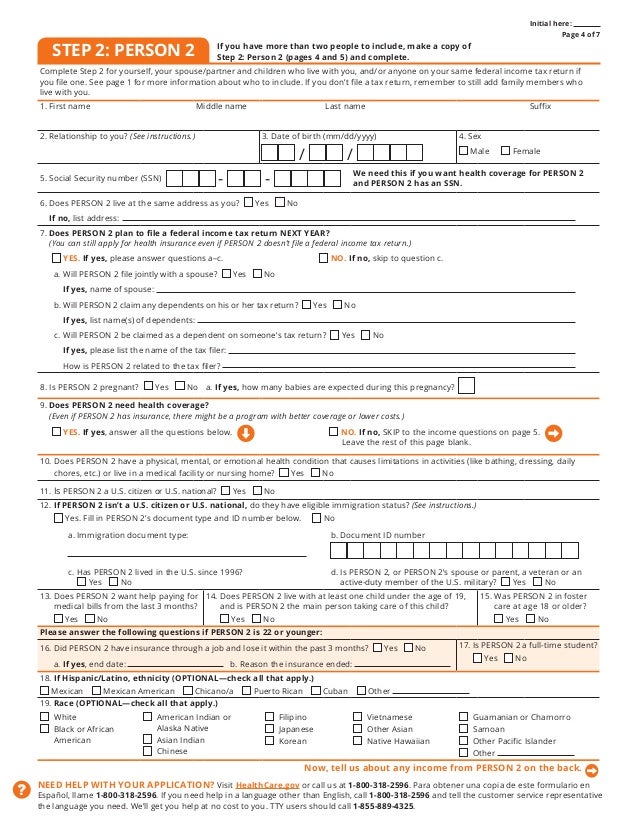

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

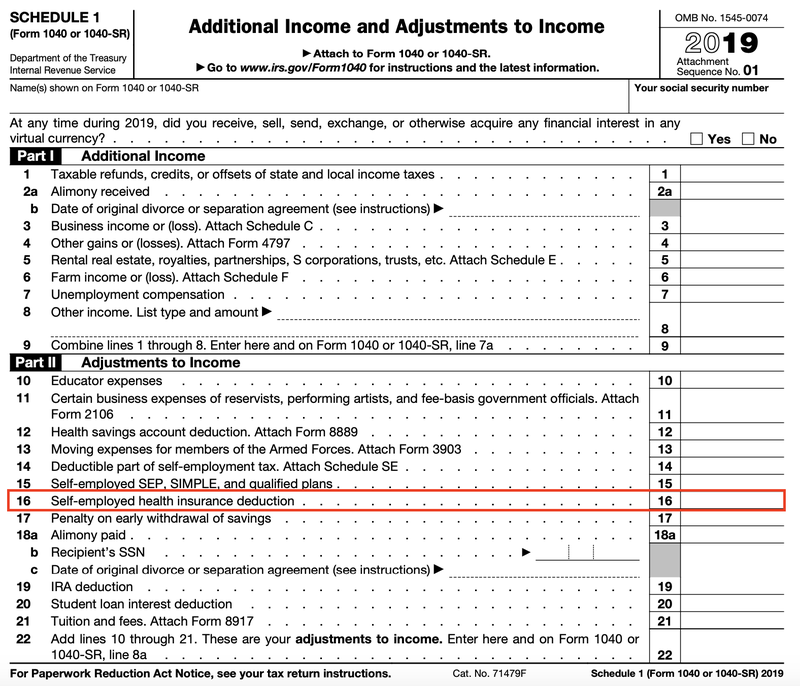

Finally on the shareholders individual tax return make sure the amount of shareholder health insurance is deducted as self-employed health insurance on the front of Form 1040.

Reporting s corp owners health insurance on w2. Your health insurance premiums paid by your business are included in your gross wages on your W-2. The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14 S. In other words the only way an S Corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholders salary.

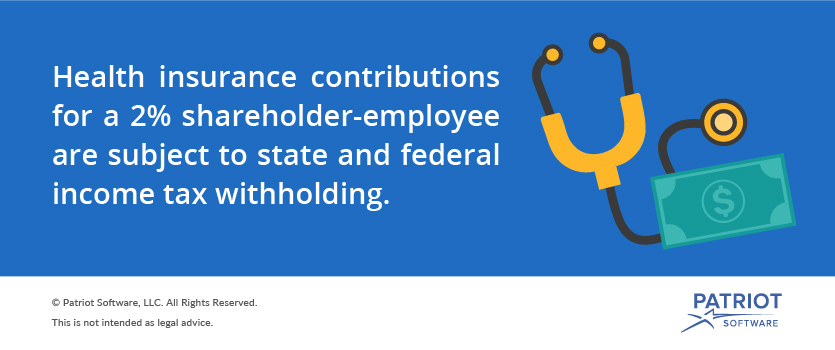

Health and accident insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employees Form W-2 subject to income tax withholding. This is the amount the shareholder deducts on page 1 of Form 1040 line 29 Self- employed health insurance deduction For more information or questions on this topic contact a member of the Tax Services Group. You pay all of the premiums and keep records of your payments.

The owners health insurance can no longer be called an insurance expense or employee benefit expense on the. If youre using the desktop version youll need to first create the payroll item and enter a liability adjustment to properly record the premium. As a greater than 2 shareholder employee of an S corporation any health disability or accident insurance premiums paid by the corporation on the shareholders behalf must be reported as taxable wages to the shareholder subject to state and federal income tax withholding.

The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14. Theres no standard list of W-2 codes for Box 14 so employers can list any description they choose for 2 health premiums including SCORP SEHLTH INS etc. The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14.

How to add S-corp owners health and life insurance to wages Our company pays 100 of our officer insurance premiums through the company. The amount is subject to federal income tax withholding. This rule also applies to the health insurance paid on behalf of your parents spouse children or grandchildren who are working for your S Corporation even if they are not shareholders of the corporation.

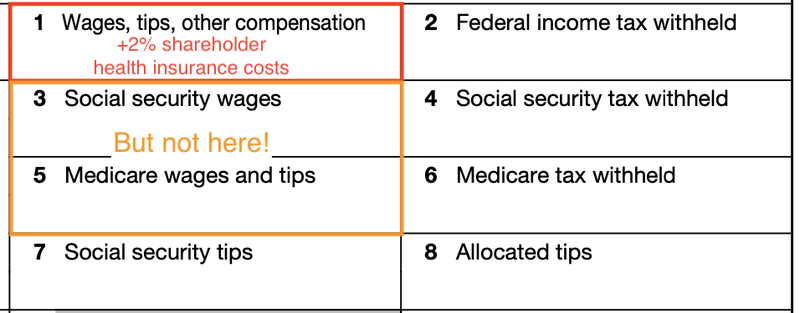

91-26 Situation 2 but not subject to FICA or FUTA excluded from Boxes 3 and 5 of W-2 Announcement 92-16. S Corporation stockholders who own at least 2 of stock are considered self. On the W-2 the amount of the premiums is recorded in box 1 wages in the state wages and in box 14 as SH Health Ins or a similar description.

You obtain an accident and health insurance policy in your own name to cover you and your family. S-Corp to include the health insurance premiums in the 2 shareholder-employees W-2 Box 1 wages but not Box 3 SS wages and Box 5 Medicare wages. Health insurance premiums paid by an S Corp for more than 2 shareholders must be treated as wages to that owner.

I created the SCorpMed payroll item as a company contribution and created a year end check that was zero dollar but had this item as an addition so that it would flow through to the W2. Health insurance premiums paid by an S corporation on behalf of its 2 percent shareholders should be reported as wages on shareholder W-2 forms. Treatment by 2-percent Shareholder-Employee.

Too often these payments are not included in wages because the premiums are paid along with those for rank-and-file employees. S-Corp to pay or reimburse the health insurance premiums. The cost of health insurance premiums paid by the S corporation for a 2 shareholder is included in the shareholders W-2 as Box 1 taxable income.

S Corporation Compensation and Medical Insurance Issues. The cost of the premiums paid on their behalf must also be included in wages on their Form W-2 in Box 1 and Box 14. The main benefit the shareholderemployee receives from reporting the insurance premiums on his or her W-2 is the option to take the health insurance premiums as a deduction to gross income on line 29 of page one of the shareholders 1040.

If you are a 2 shareholder and offer the same medical insurance plan. Theres no standard list of W2 codes for Box 14 so employers can list any description they choose for 2 health premiums including SCORP SEHLTH INS etc. On Form 941 the value of the insurance would be reported.

Since your portion of S corp income is only 12500 50000 x 025 ownership thats the maximum self-employment health insurance deduction you can take despite higher premiums. From the corporations perspective premiums are different than payroll. How do I.

The amount of health insurance is includable in the shareholders compensation Box 1 of Form W-2 Rev. The only proper procedure is for the. I can help ensure your S-Corp Owners Health Insurance premium is properly recorded so it will be reported on the W-2 form.

You can read more about this here.

How To Deduct Shareholder Health Insurance For S Corporations Amy Northard Cpa The Accountant For Creatives

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Can I Get Health Insurance Through My Llc

Health Insurance And W 2 Reporting For Shareholders Of S Corporationsgranite Payroll

A Beginner S Guide To S Corp Health Insurance The Blueprint

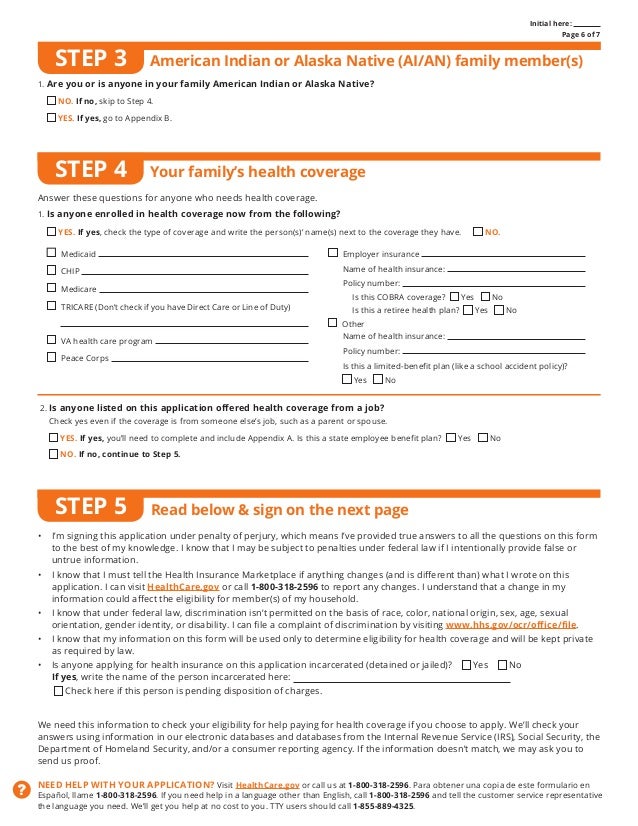

Health Insurance Marketplace Application For Family Obamacare From

Health Insurance Marketplace Application For Family Obamacare From

What Is 2 Shareholder Health Insurance Definition Benefits

Is A Health Insurance Premium Tax Deductible With Llc Legalzoom Com

Blog The Tunstall Organization Inc The Tunstall Organization Inc

How To Deduct Your Health Insurance As A 2 Shareholder Hourly Inc

A Beginner S Guide To S Corp Health Insurance The Blueprint

Tax Blog Why Blu Tax Accounting

All You Need To Know About S Corp Health Insurance Blue Lion

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Self Employed Health Insurance Deduction Healthinsurance Org

Post a Comment for "Reporting S Corp Owners Health Insurance On W2"