Self Insured Retention Deductible

However in the modern marketplace improving or even maintaining retention rates takes hard work and intentional actions. A SIR or a Deductible - What is the Difference.

Self Insured Retention V Deductible What Is The Difference And Why It Can Matter Bell Davis Pitt

Deductibles erode the limit of your.

Self insured retention deductible. Self-Insured Retention SIR a dollar amount specified in a liability insurance policy that must be paid by the insured before the insurance policy will respond to a loss. February 2 2011 Presented By. A retention or self-insured retention SIR sometimes known as a retained limit is a feature of an insurance pol-icy under which an initial portion of cov-ered risk is borne by the policyholder not the insurer.

Thus under a policy written with a SIR provision the insured rather than the insurer would pay defense andor indemnity costs associated with a claim until the SIR limit was reached. For example a policy with a 1000000 limit and a 100000 deductible technically only provides 900000 of insurance. In a Self Insured retention structure you must provide the infrastructure.

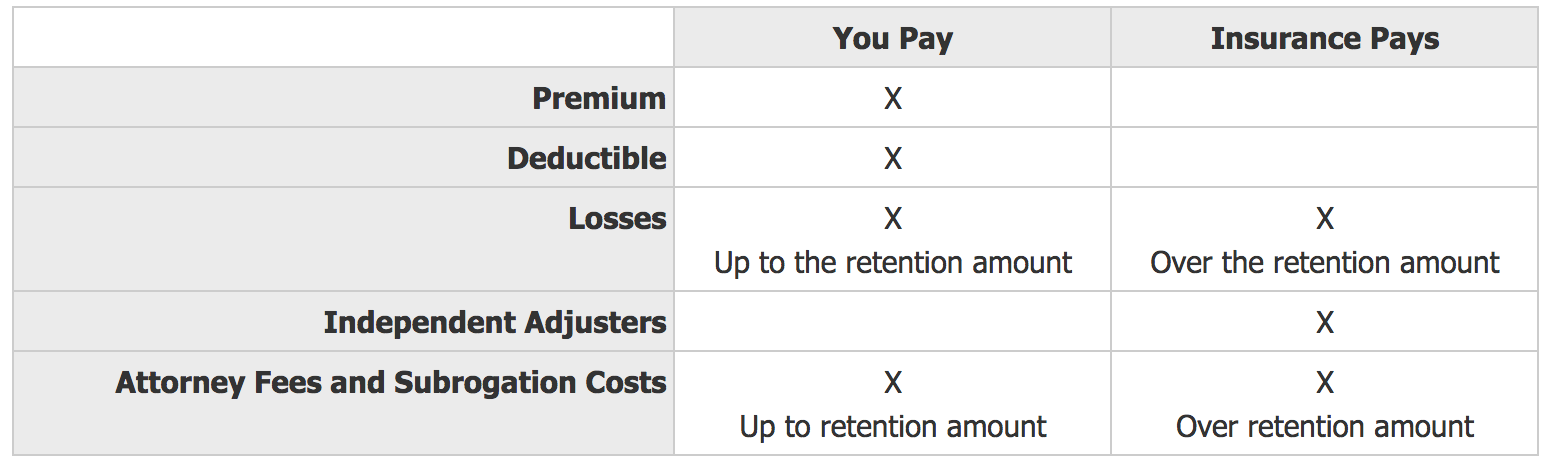

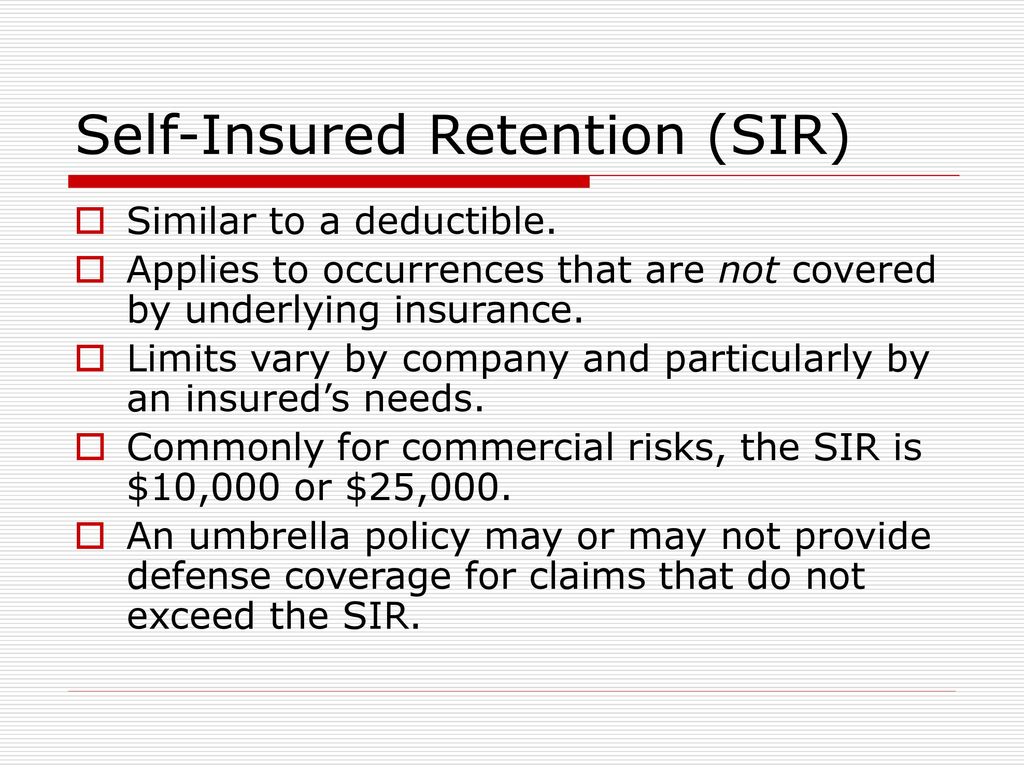

Insurance with an SIR essentially sits as excess coverage above a primary layer of self-insurance. Both sir and deductibles are used to keep premiums down. Deductibles and Self Insured Retentions SIRs are mechanisms which require the insured to bare a portion of a loss otherwise covered by an insurance policy.

And Deductibles The Basics. However there are a few key differences to note depending on whether your policy contains a self-insured retention or a deductible. Attorneys practicing in the insurance coverage arena have inevitably been faced with insurance policies that contain self-insured retentions SIRs or deductibles.

Although these two mechanisms are economically similar they differ in significant respects and should not be. A self-insured retention also widely known under its abbreviation SIR refers to the amount that an insured has to pay in order for an insurance policy to kick in. Introduction Policies containing deductibles or SIRs present a significant.

Allocation of Deductibles and Self-Insured Retentions in Insurance Claims Febr ar 2 2011 Presented By. Although policies can vary in general a deductible plan will pay up to a certain amount including the deductible. Deductibles erode the limit of your insurance.

Self-Insured Retention SIR a dollar amount specified in an insurance policy that must be paid by the insured before the insurance policy will respond to a loss. In a deductible plan your insurer takes on the immediate risk of paying out losses up to the limit of your policy relying on the insured to eventually pay back the deductible. In its function it is similar to an insurance deductible although each of the two concepts has its own distinguishing features.

With a deductible policy the insurer pays for losses and then collects reimbursement from you afterward up to the. Adjusters Loss Control Engineers Legal representation defense a professional accident investigation team. The insurer provides immediate defense pays.

The answer to the question whats the difference between a deductible and a self insured retention is that deductibles reduce the amount of insurance available whereas a self insured retention is applied and the limit of insurance is fully available above that amount. Consequently a policy which has a sum insured of 1m and a deductible of 100000 will pay a maximum of 900000 whereas by contrast were it to sit above a SIR of 100000 then the maximum recoverable would be 1000000. A deductible is a feature of an insurance policy under which the insurer after defending a lawsuit and paying a cov -.

This includes the consideration to the extent a balance sheet may allow to retain a larger portion of risk through the use of self-insured retentions or deductibles. The two concepts are often confused andor use the terms interchangeably. With a deductible the insured notifies the insurer when there is a claim.

The major benefit of Self-Insured Retention Insurance policies is lower premiums. Retention is essentially a deductiblethe amount the insured is responsible for paying out of pocket before the insurance policy starts paying out on a claim. Below are the three key differences between self-insured retention and deductibles.

An insurance policy that has a deductible structure includes the carriers infrastructure for you to leverage.

Self Insured Retention What It Is And How It Works Harris Insurance

Https Www Icwgroup Com Earthquake Library Icw Group Dic Self Insured Retention Pdf

What Is Self Insured Retention Insurance Advisorsmith

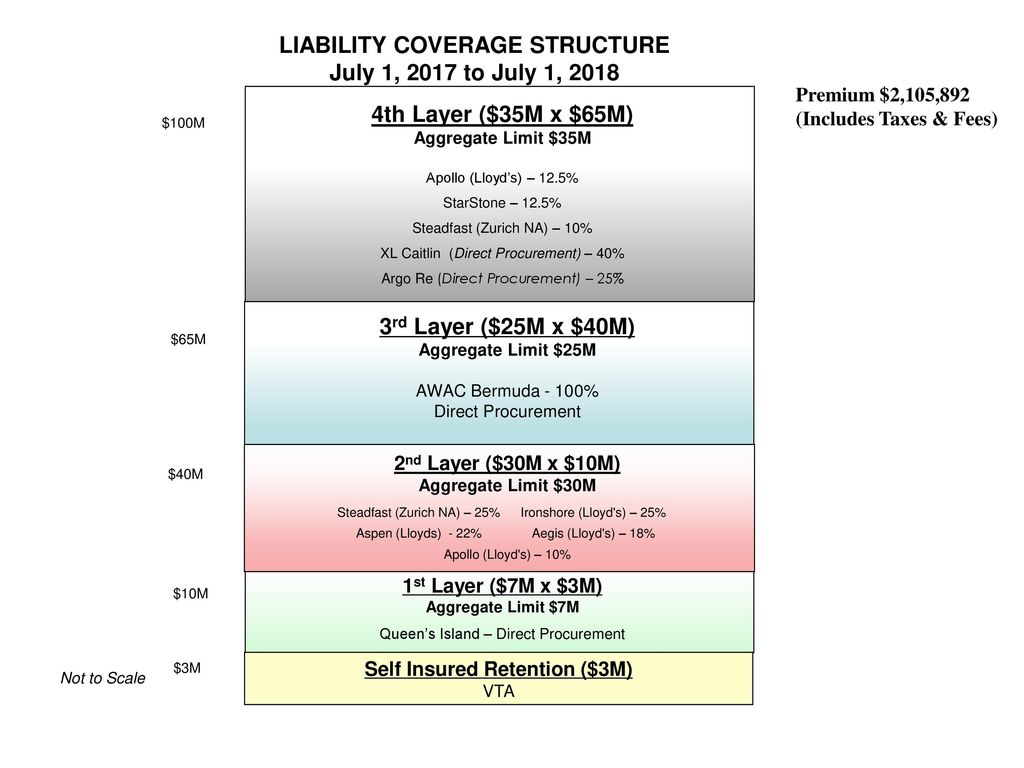

Liability Coverage Structure Self Insured Retention 3m Ppt Download

Self Insured Retention Vs Collateral

Self Insured Retentions Versus Deductibles Expert Commentary Irmi Com

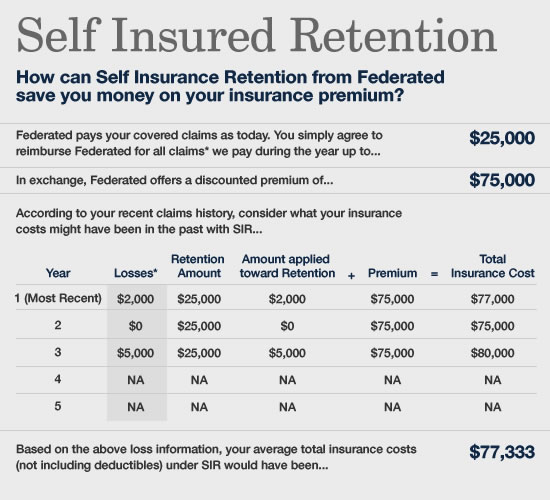

Sir A Profit Center For Your Business American International Automobile Dealers

Sir A Profit Center For Your Business American International Automobile Dealers

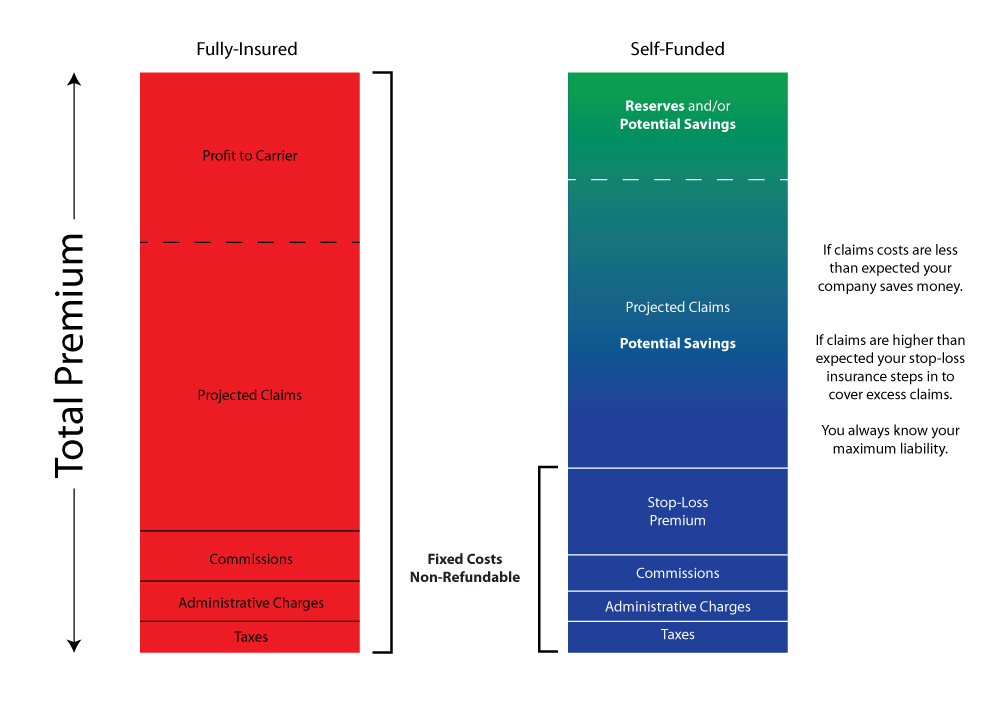

Fully Insured Vs Self Funded Shenandoah Valley Group

Self Insured Retention An Alternative To The Insurance Deductible Reshield

Self Insured Retentions Part 2 An Examination Of The Uses And Proble

Self Insured Risks Captive Insurance 101

Deductibles Vs Self Insured Retention

Managing Your Risk Self Insured Retentions Vs High Deductibles Propertycasualty360

The Corridor Self Insured Retention Expert Commentary Irmi Com

Liability Coverage Structure Self Insured Retention 3m Ppt Download

Excess Liability Vs Umbrella Liability Ppt Download

Marketing Agency Of The Month Read Understand Advise Ten Eyck Group Brings Policy Expertise To Its Clients 12 13

Http Media Straffordpub Com Products Insurance Sirs And Deductibles Navigating Impact On Satisfaction Of The Sir Policy Limits Duty To Defend And Additional Insureds 2014 08 27 Presentation Pdf

Post a Comment for "Self Insured Retention Deductible"