S Corp Health Insurance W2 Box 12

Check out our affordable health plans and calculate your premium. Go to Workers from the left menu.

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

LLC taxed as S-corp Owner receives a W2.

S corp health insurance w2 box 12. In QuickBooks Online QBO youll need to set up an S-corp Insurance for it to automatically reflect on your W-2 forms. Also the amounts in Box 1 attributable to insurance premiums are then broken out in Box 14 of the W-2. Advertentie Health Insurance Plans Designed for Expats Living Working in Netherlands.

- Applicable For Foreign Citizens Only - Not for Local citizens students. Advertentie Get more out of your healthcare insurance. This rule also applies to the health insurance paid on behalf of your parents spouse children or grandchildren who are working for your S Corporation even if they are not shareholders of the corporation.

Do I have to enter HI premiums there. Own an S corp and reimbursed myself for health insurance premiums. I have a question concerning 2016 Health Insurance for S Corporation Owners.

Advertentie Compare 50 Health Insurance Plans Designed for Expatriates. - Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover. Advertentie Health Insurance Plans Designed for Expats Living Working in Netherlands.

The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14. I get how the S corporation includes the reimbursed premiums on the owners W-2 but Im not sure if I also put the health insurance reimbursement amount in box 12 of the W-2 and if I do what code letter L should I use. Get a Free Quote.

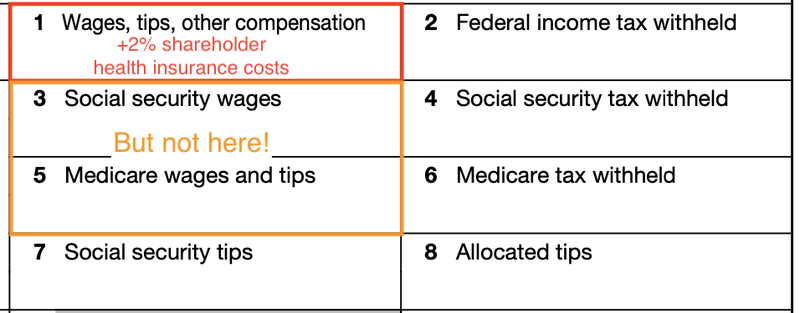

Advertentie Protect yourself from private medical expenses while living working abroad in Netherland. - Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover. The cost of the premiums paid on their behalf must also be included in wages on their Form W-2 in Box 1 and Box 14.

Notice 2008-1 states that if the shareholder purchased the health insurance in his own name and paid for it with his own funds the shareholder would not be allowed an above-the-line deduction. Heres how to set up an S-corporation pay type. - Applicable For Foreign Citizens Only - Not for Local citizens students.

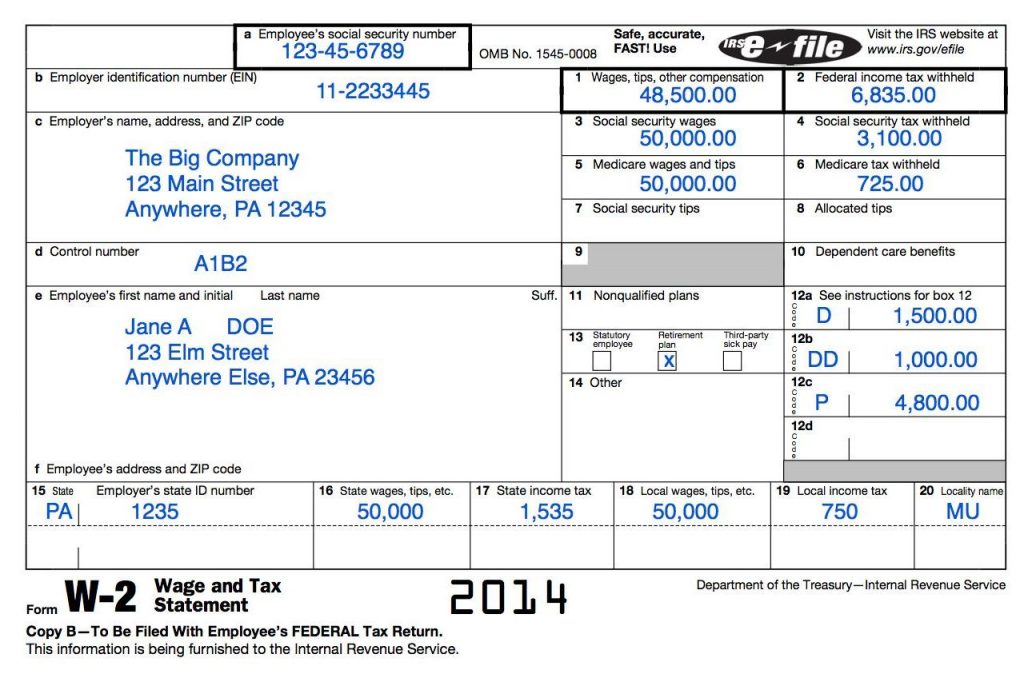

This is the amount the shareholder deducts on page 1 of Form 1040 line 29 Self- employed health insurance deduction. It added the total to Wages so my wages went up by health insurance premium. The main benefit the shareholderemployee receives from reporting the insurance premiums on his or her W-2 is the option to take the health insurance premiums as a deduction to gross income on line 29 of page one of the shareholders 1040.

Check out our affordable health plans and calculate your premium. I can guide you through in adding the 2 S-corp health insurance to your W-2 form. I am now filing W3s so I can issue myself a W2.

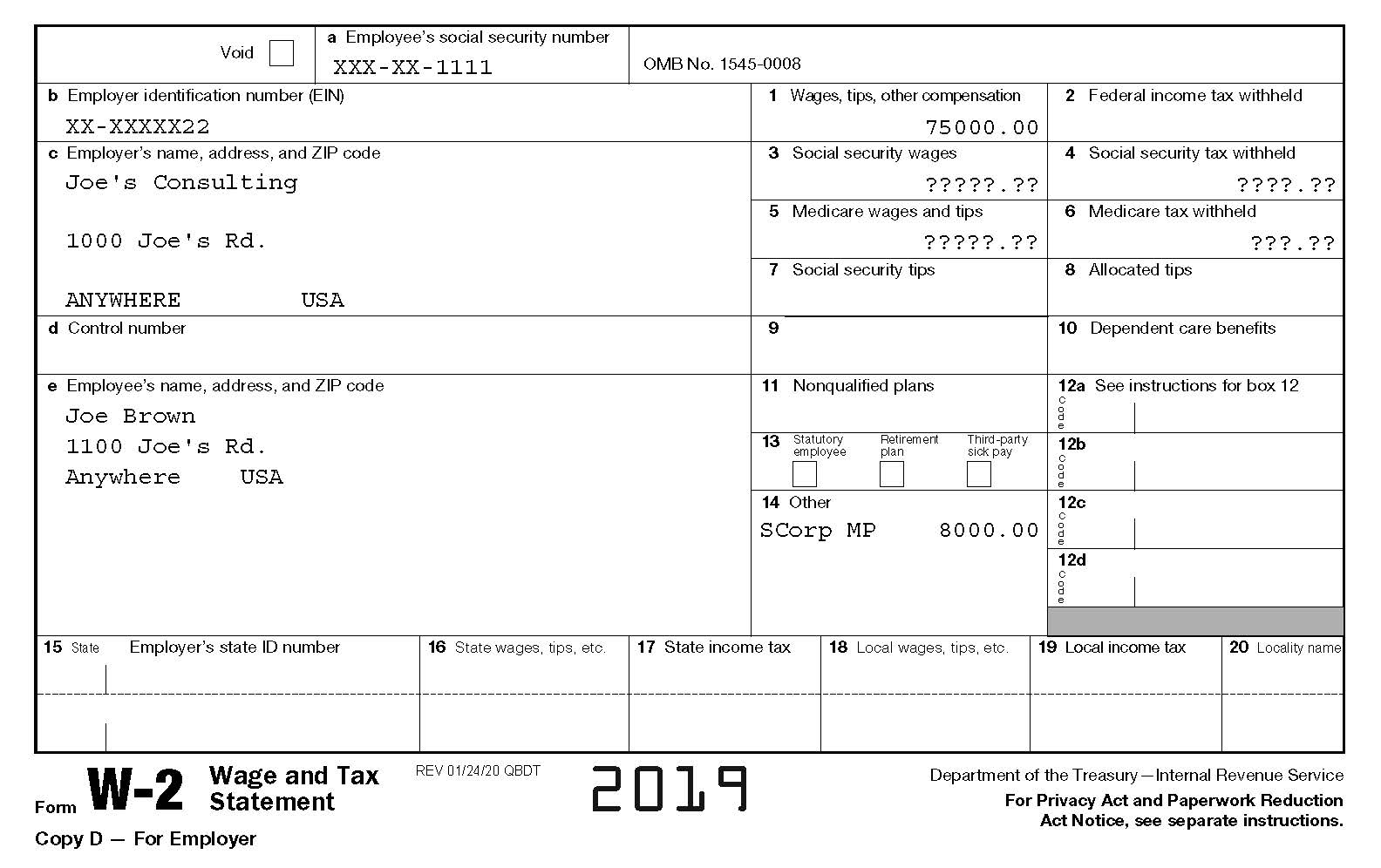

Get a Free Quote. Scorp owner W2 - HSA contribution Box 12 or 14 W2 seems to need correction please advise. Advertentie Get more out of your healthcare insurance.

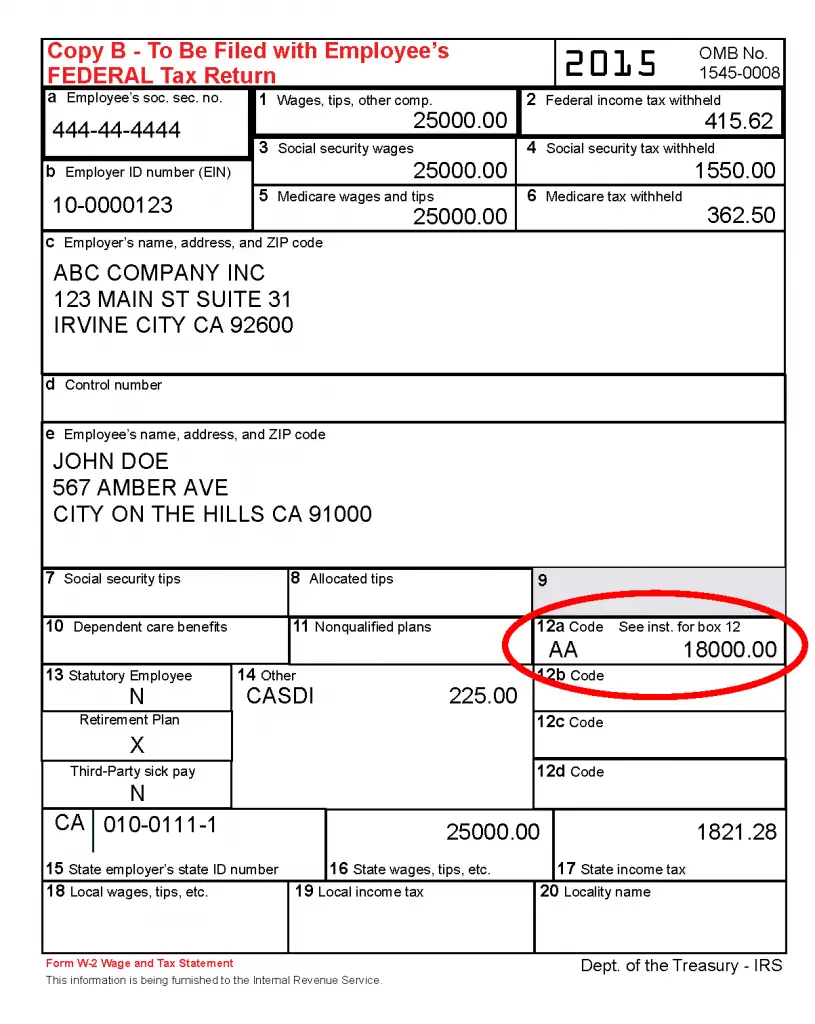

The S corporation receives a deduction for health insurance of greater-than-2 shareholders as compensationwages on Line 8 or 9 of Form 1120S depending on whether the shareholder is an officer. Learn to achieve the maximum tax advantage for S corp health insurance. 54045 Box 3 60000 Box 5 60000 12a 18500 12b W 6900 14 CASDI 63450 14 Scorp Health.

S corporations can offer health insurance premium coverage for non-owner employees. Select the employees name. Advertentie Compare 50 Health Insurance Plans Designed for Expatriates.

What about box 14 or 12 dd. Do I enter total wages plus HI premiums in Box 1 then just wages without premiums in box 3 and 5. The S corporation does not report the value of health insurance in Box 12 using code DD.

Advertentie Protect yourself from private medical expenses while living working abroad in Netherland. S-corp contributed to HSA this is what current W2 looks like. This is the amount the shareholder deducts on Line 16 Schedule 1 Form 1040 as a self-employed.

Notice 2008-1 provided four examples including three examples in which the shareholder purchased the health insurance and one in which the S corporation purchased the health insurance. The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14 S. Theres no standard list of W-2 codes for Box 14 so employers can list any description they choose for 2 health premiums including SCORP SEHLTH INS etc.

What Do The Letter Codes In Box 12 Mean Avocadough Toast

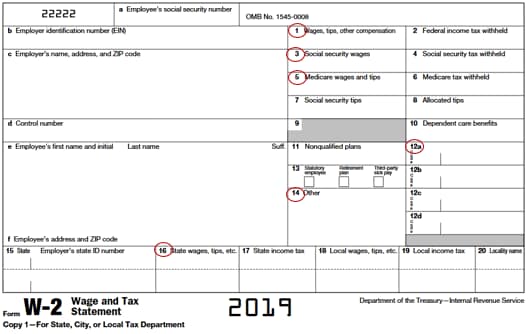

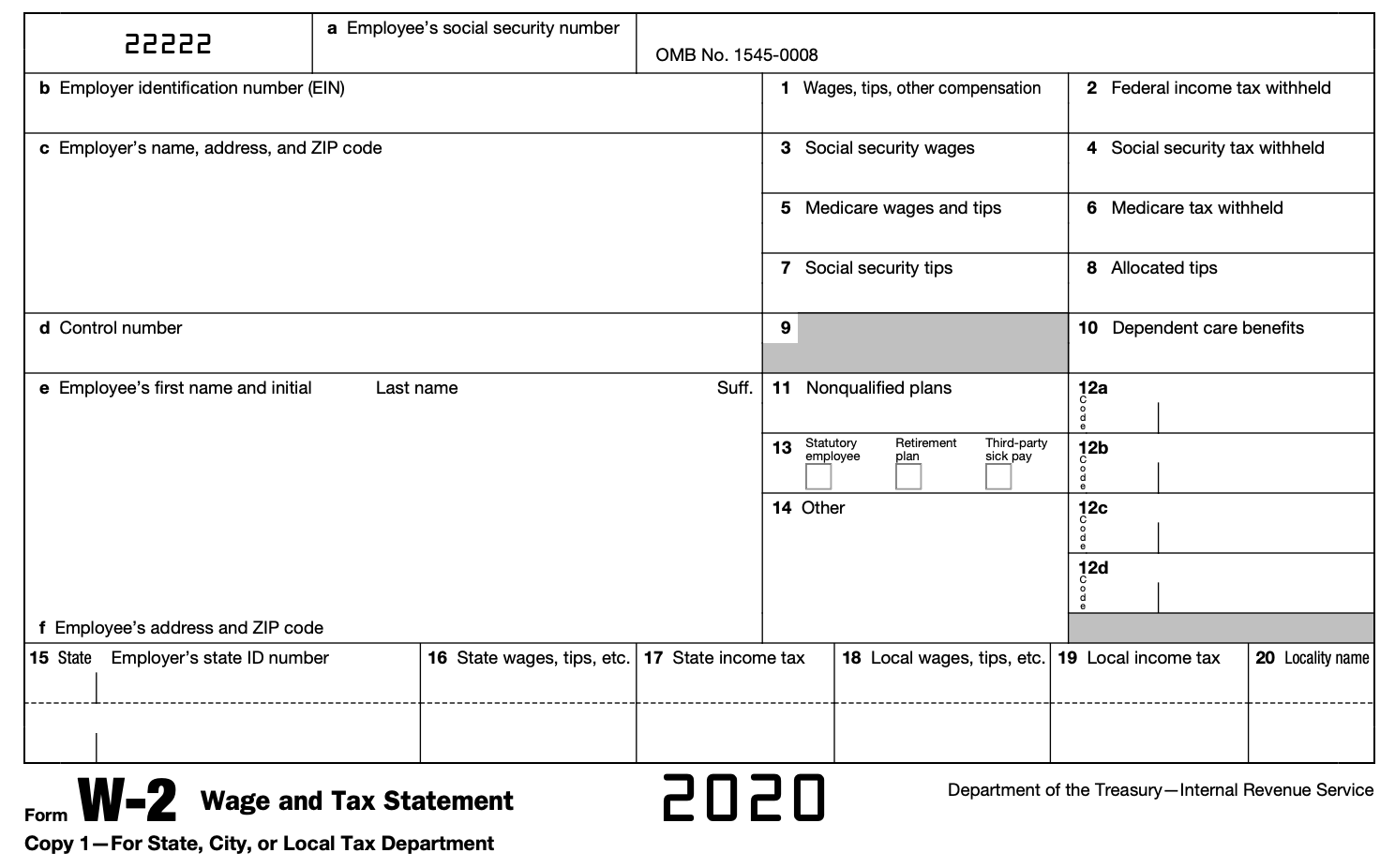

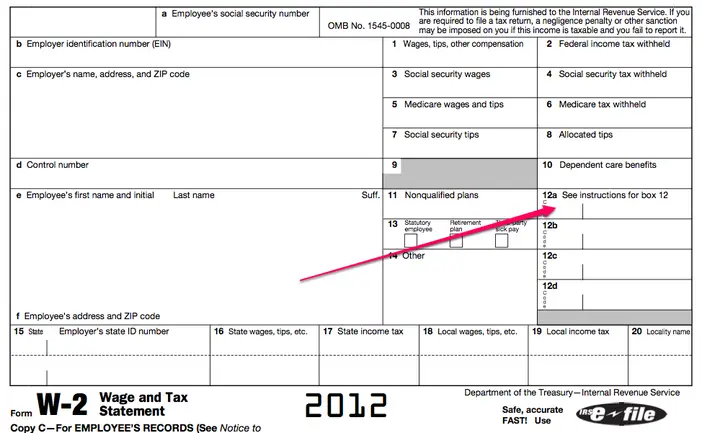

Reports And Info About W 2 And W 3 Forms

Taxability Of S Corp Health Premiums Included In Salary Cpa Certified Public Accountant Income Taxes Accounting Services Gary Boyd Cpa

Wage Tax Statement Form W 2 What Is It Do You Need It

How To Read Your W 2 Justworks Help Center

What Do The Letter Codes In Box 12 Mean Avocadough Toast

A Beginner S Guide To S Corp Health Insurance The Blueprint

Wage Tax Statement Form W 2 What Is It Do You Need It

What Do The Letter Codes In Box 12 Mean Avocadough Toast

Loss Of Coverage Letter Template New Self Employment Profit And Loss Statement Home Business Profit And Loss Statement Statement Template Letter Templates

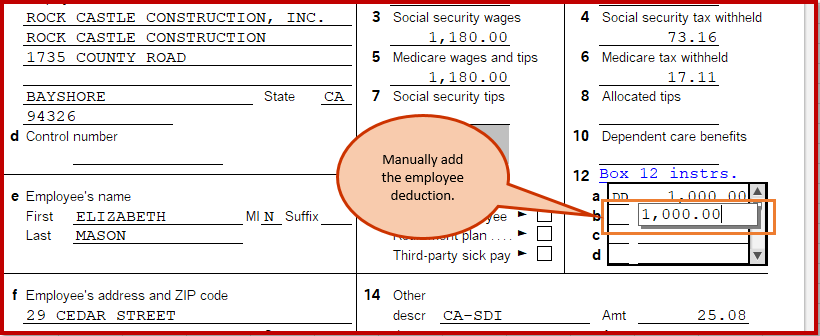

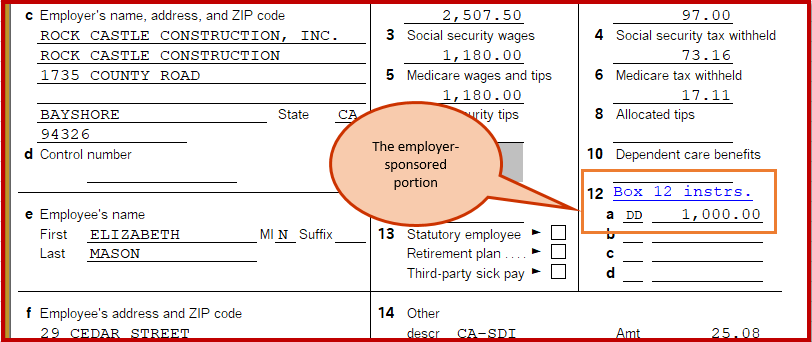

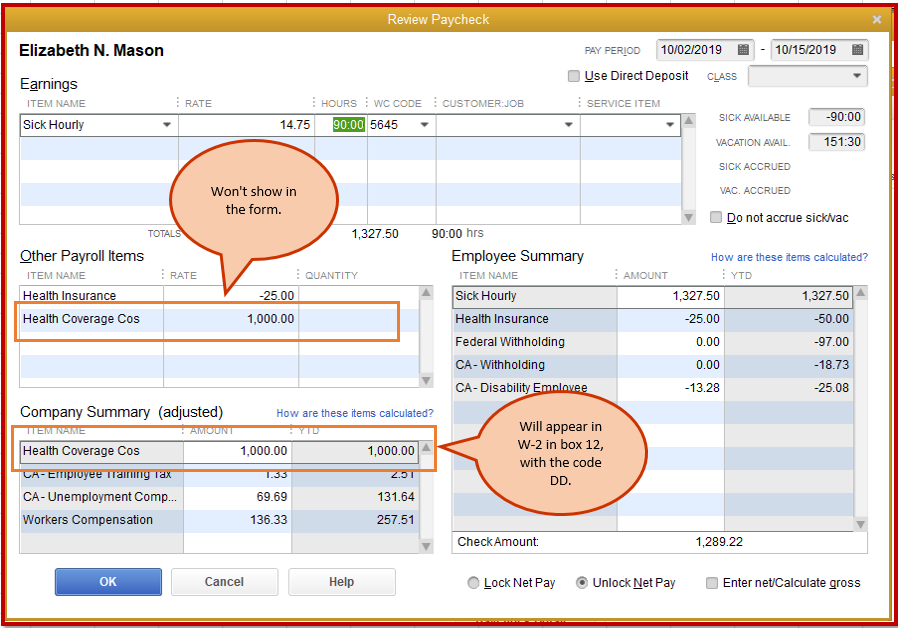

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance

How To Read Your 1099 Justworks Help Center

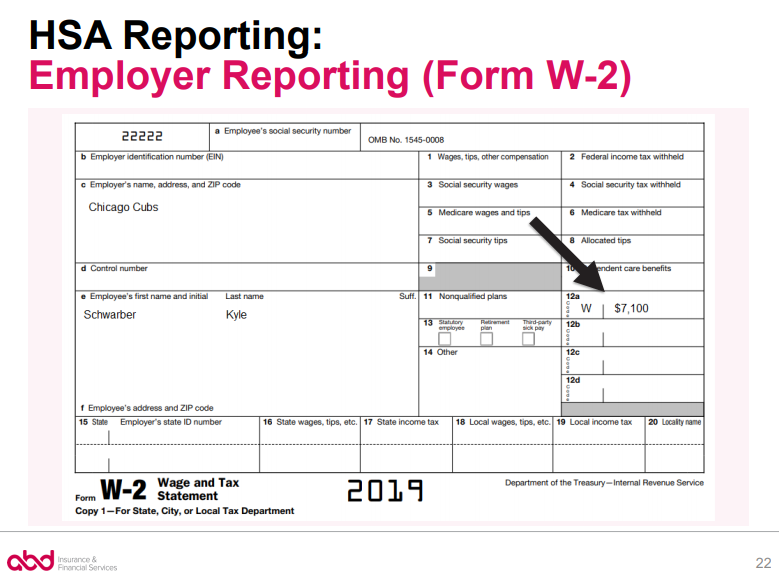

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Succession Planning Benefits Business In 2021 Succession Planning Scholarships Application Essay Writing

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Post a Comment for "S Corp Health Insurance W2 Box 12"