Sba Disaster Loan Insurance Requirements

The insurance coverage must also contain either a Mortgagee clause or Lenders Loss Payee clause in favor of the Lender. Continued on page 61 The RMA Journal May 2010 59.

Do You Qualify For An Sba Disaster Loan Divvy

The SBA requires the amount of insurance obtained by the borrower to be the lesser of the outstanding principal balance of the loan or the maximum limit of available coverage 500000 per NFIP guidelines.

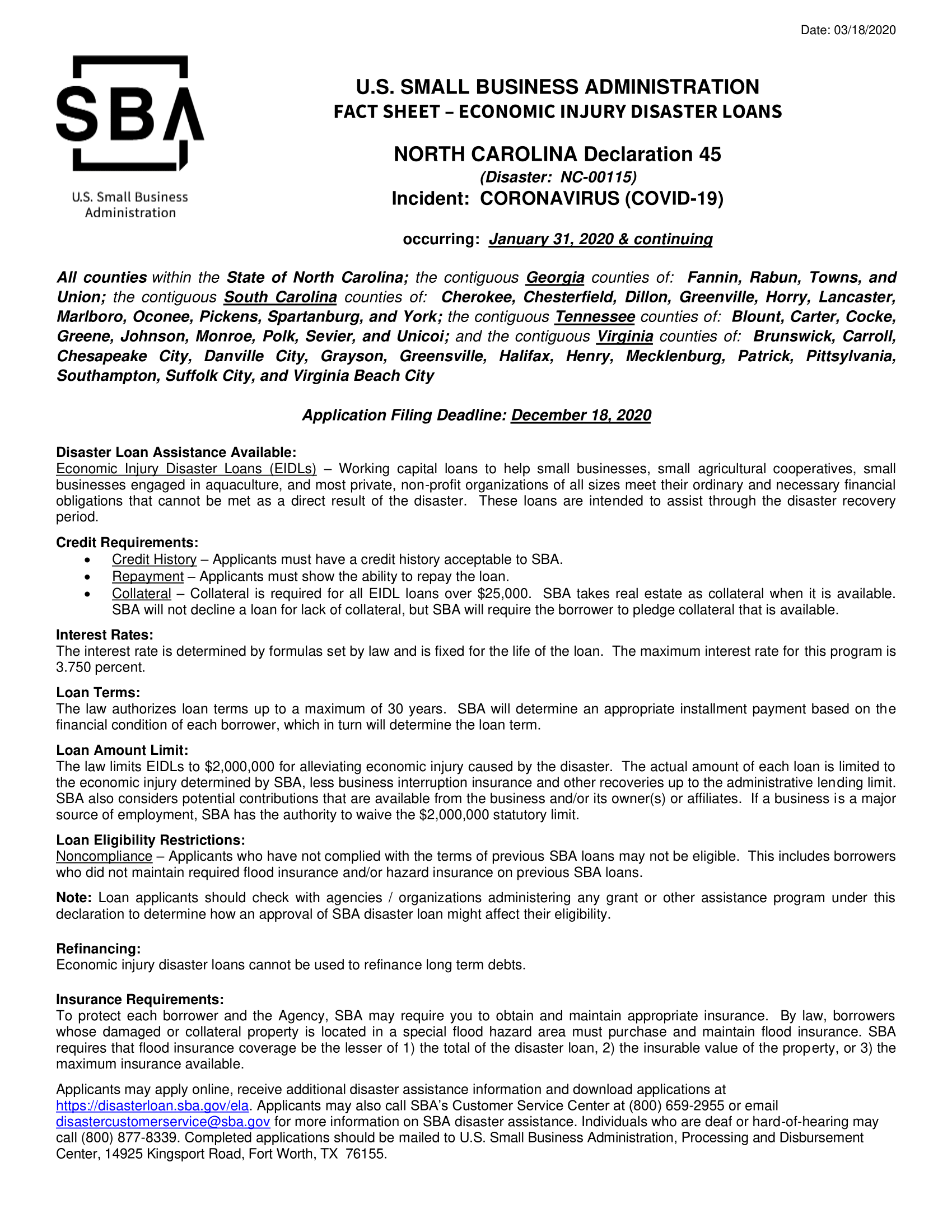

Sba disaster loan insurance requirements. You can Check Disaster Declarations to locate disaster areas by state and territory. You can reach out to them at disastercustomerservicesbagov with any inquiries. Economic Injury Disaster Loans over 25000 require collateral SBA takes real estate as collateral when it is available SBA will not decline a loan for lack of collateral but requires borrowers to pledge what is available West Virginia District Office 7 7.

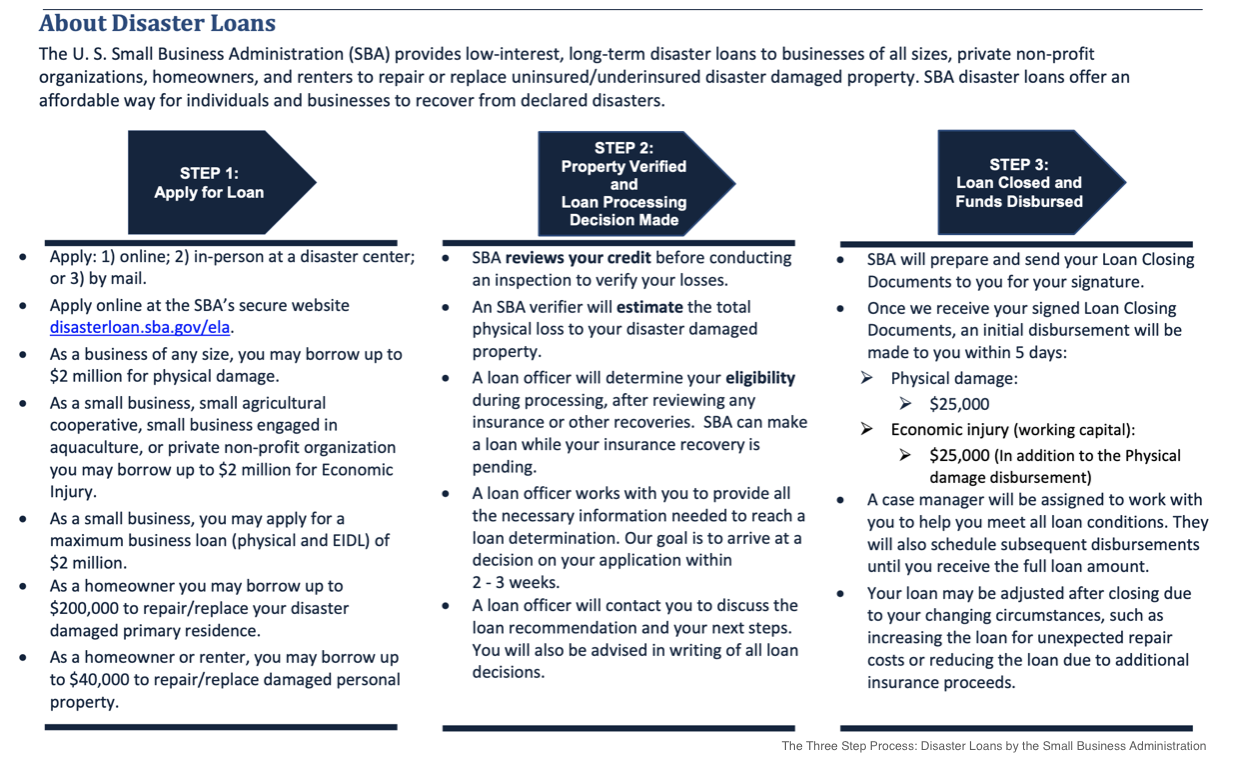

The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters. You must be in an SBA declared disaster area to be eligible for SBA disaster assistance. The SBA also requires that borrowers obtain flood insurance under the National Flood Insurance Program NFIP on real estate and business personal property in the following instances.

If a business receives an SBA-guaranteed loan for 5 million the maximum guaranty to the lender will be 375 million or 75 percent. Overall SBA loan requirements are tedious. For this reason the Small Business Administration requires all borrowers to obtain hazard insurance within 12 months of getting approved for one of their loans.

EIDL assistance is available only to entities and their ownerswho cannot provide for their own recovery from. If you are in a declared disaster area and have suffered any disaster related damage you may be eligible for federal disaster assistance. SBA Required Coverages Determining Your Requirement SBA Insurance Policy The CARES Act for Small Businesses The CARES Coronavirus Aid Relief and Economic Security Act is a stimulus bill providing 2 Trillion of desperately needed economic relief some of which is going to small businesses as they navigate the Coronavirus COVID-19 pandemic.

SBA Export Express loans have a maximum loan amount of 500000. Under the requirements for the EIDL the SBA requires that your business has hazard insurance to cover 80 of the loan amount. If you arent quite at the 620 mark you might still qualify for a disaster loan.

But do you have enough hazard insurance. You can apply for a disaster loan online. The Duty to Maintain Hazard Insurance requirement may be found on page 4 of the Loan Authorization and Agreement which you signed the Borrower will provide proof of active and in effect hazard insurance policy including fire lightning and extended coverage on all items used to secure this loan to at least 80 of the insurable value.

The SBAs maximum exposure is 375 million 45 million under the International Trade loan. If you borrow 250000 over ten years you should buy a 250000 term life insurance policy that lasts at least ten years. However the SBA usually wants to see a credit score of 620 or higher.

Loan LimitsThe law limits EIDLs to 2000000 for alleviating economic injury caused by the disaster. Subject to these maximums loan amounts cannot exceed the verified uninsured disaster loss. You should always purchase term life insurance for SBA loans that match the term and coverage amount of your loan.

The actualamount of each loan is limited to the economic injury determined by SBA less business interruption insurance and other recoveries up to the administrative lending limit. Hazard insurance is a term for coverage the may be included within. If you took out an SBA disaster loan last spring you may have recently been asked to verify insurance.

Insurance policies are only part of the SBAs tedious requirements. Currently the SBA is requiring that your hazard insurance is at least 80 of your loan amount. Homeowners and Renters must register with the Federal Emergency Management Agency to obtain a FEMA Registration ID Number by calling 1-800-621-3362.

See how two owner-ops dealt with it here on Overdrive. For example at the very least youll need excellent personal credit strong business income and adequate collateral. When it comes to SBA disaster loan credit score requirements theres no hard and fast minimum credit score youll need for approval.

That includes all Economic Injury. Home Loans SBA regulations limit home loans to 200000 for the repair or replacement of real estate and 40000 to repair or replace personal property.

Frequently Asked Questions About Sba Disaster Loans Real Marketing

Sba S Economic Injury Disaster Loan Program Womble Bond Dickinson Jdsupra

Sba Disaster Loans Requirements And Application Instructions

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

From Sba Create Your Sba Economic Injury Disaster Loan Portal Account Uber Drivers Forum

New 2 Form Submission For Eidl

Blue Williams Covid 19 Cares Act And Sba Business Assistance

3 Steps To Apply For An Sba Economic Injury Disaster Loan Eidl

How To Apply For The Sba Economic Injury Disaster Loan Rapid Finance

Sba Returning To Help With Disaster Loan Process The Newnan Times Herald

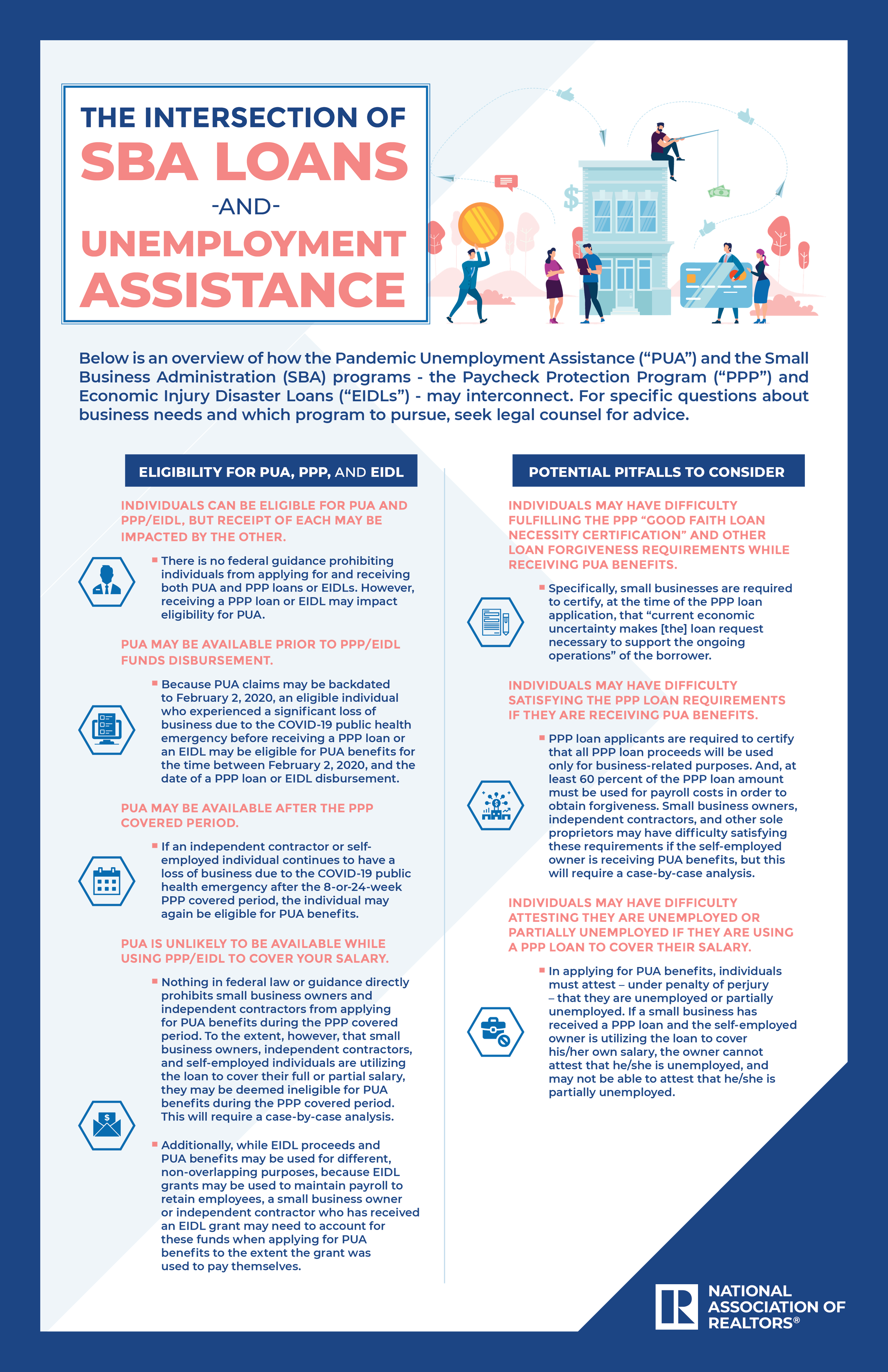

The Intersection Of Sba Loans And Unemployment Assistance

Sba Disaster Loan Program Frequently Asked Questions Everycrsreport Com

Coronavirus Covid 19 Small Business Guidance Loan Resources Southern Oregon Business Journal

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

Sba S Economic Injury Disaster Loan Program Womble Bond Dickinson Jdsupra

Lenoir Economic Injury Disaster Loans Being Made Available Through The U S Small Business Administration

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 15 2020 10am Pdf

Applying For Sba Eidl Disaster Assistance

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Post a Comment for "Sba Disaster Loan Insurance Requirements"