Risk Exposure In Insurance Definition

2 a person or thing insured. Definition Types The risk is a concept which relates to human expectations.

The lowest-risk-exposure activities have both low potential loss and low probability that the loss will be incurred while the opposite is true for high-risk-exposure activities.

Risk exposure in insurance definition. Financial institutions also employ a different type of risk. It denotes a potential negative impact on an asset or some characteristic of value that may arise from some present process or some future event. Risk exposure refers to the level of loss that an employer may potentially incur by engaging in a particular activity combined with the probability that he or she will incur that loss.

The risk assumed by the insurer is the risk of as in all. In a working layer where some claims are. The insuranceinsurer perceives risk as an uncertainty based on the unpredictable nature of.

RISK MANAGEMENT has a two-fold definition. Single Value The basic calculation for risk exposure is based on an estimate of the probability of a risk and its impact. Exposure may have different meanings.

These include the maximum possible claims cost the probable claims cost and the probable claims cost given the occurrence of a specific event. It is the assurance that the structures necessary to minimize the probability of a loss are in place and understood by all levels of an organization policies and procedures. Risk exposure is an estimate of the probable costs of a risk or set of risks.

In insurance terms exposure refers to an individual business or entitys susceptibility to various losses or risks they might encounter in life or in the ordinary course of business. Definition of Asymmetric risk exposure Bob McGrath Real Estate Agent Key Realty Gain when the underlying asset that moves in one direction is significantly different from the loss when the underlying asset moves in the opposite direction. Exposure may have differing uses depending on the type of risk.

There are three basic ways to calculate risk exposure. So for one risk several values of exposure may be needed. Risk definition exposure to the chance of injury or loss.

This can be calculated for a strategy program project or initiative. For example if there is a. However some actions entail more risk than others.

Risk Definition Insurance. About Risk Exposure - Insurance is a tranfer of risk of loss from and individual or a bsuiness entity to an insurance company. In a broader sense risk is the possibility of loss injury or any other adverse in a present or future situation involving exposure to hazarddanger.

In contrast most insurance industry contracts and education and training materials use the term exposure. In common English language many people continue to use the word risk as a noun to describe the enterprise property person or activity that will be exposed to losses. Basically it refers to their potential for accidents or other types of losses like crime fire earthquake etc.

Risk exposure is a measure of possible future loss or losses which may result from an activity or occurrence. The practice of identifying and analyzing loss exposures and taking steps to minimize the financial impact of the risks they impose. If you drive a car more often you face more exposure to car.

In everyday usage risk is often used synonymously with probability of a loss or threat. Exposure is used by insurance companies to calculate our premiums and simply put it measures our level of risk. Learn about common insurance terms and how to protect your small business with techinsurance.

It denotes the individuals potential for accidents and other losses. Insurance companies evaluate the level of risk an individual faces and use it to calculate insurance premiums. In business risk exposure is often used to rank the probability of different types.

Throughout our lives we are all under some amount of risk whether were driving a car or simply walking from the living room to the kitchen to get a glass of water. Risk management is also the. Risk exposure probability impact.

For example when gains and losses associated with purchasing a call option on a stock are significantly different. Traditional risk management sometimes called insurance risk management has focused on pure risks ie possible loss by fortuitous or accidental means but not business risks ie those that may present the possibility of loss or gain. Exposure refers to an individuals susceptibility to various risks encountered in daily life.

Private Passenger Auto Insurance Definition Di 2021 Gambar

Great Infographic Management Infographic Risk Management Infographic

Insurance Meaning Benefits Types Policy Companies Institute Life Insurance Policy Insurance Meant To Be

How Insurable Interest Works In Life Insurance Business Insurance Life Insurance Life

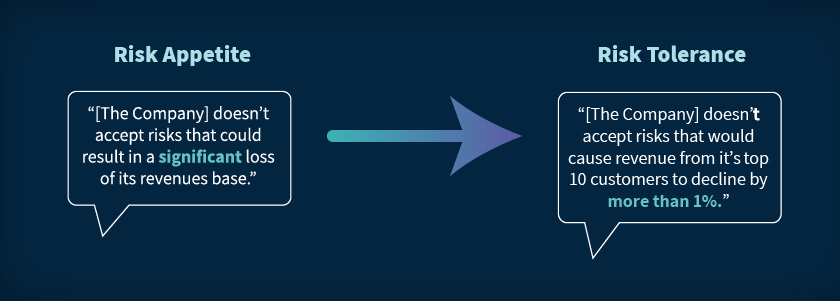

Risk Appetite Vs Risk Tolerance 2021 Definition Examples

What Is Risk Management In Healthcare

Professional Liability Are Contractors Adequately Protected Expert Commentary Irmi Com

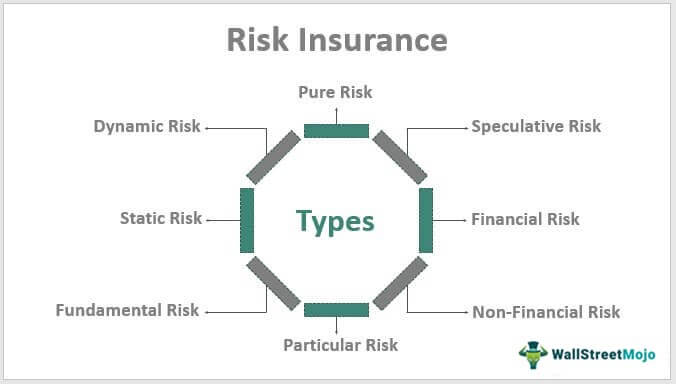

Risk Insurance Definition Top 8 Types Of Risks In Insurance

Risk Management In Construction Process Of Managing Risk Risk Management Risk Management Plan Example How To Plan

Table 4 Risk Exposure Rating Risk Management Risk Analysis Change Management

Infographic The Six Steps Of The Nist Risk Management Framework Rmf Security Boule Risk Management Cyber Security Education Systems Development Life Cycle

.jpg)

What Is Risk Management Clearrisk

5 1 Introduction To Exposure Vulnerability And Risk Assessment Charim

What Is Risk Management Clearrisk

Compass Eam Enterprise Asset Management Facilities Maintenance Software Uk Usa Ireland Project Risk Management Risk Management Risk Analysis

Project Risk Management Using Qualitative Risk Analysis Project Risk Management Risk Management Risk Analysis

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Post a Comment for "Risk Exposure In Insurance Definition"