Reps And Warranties Insurance Policy

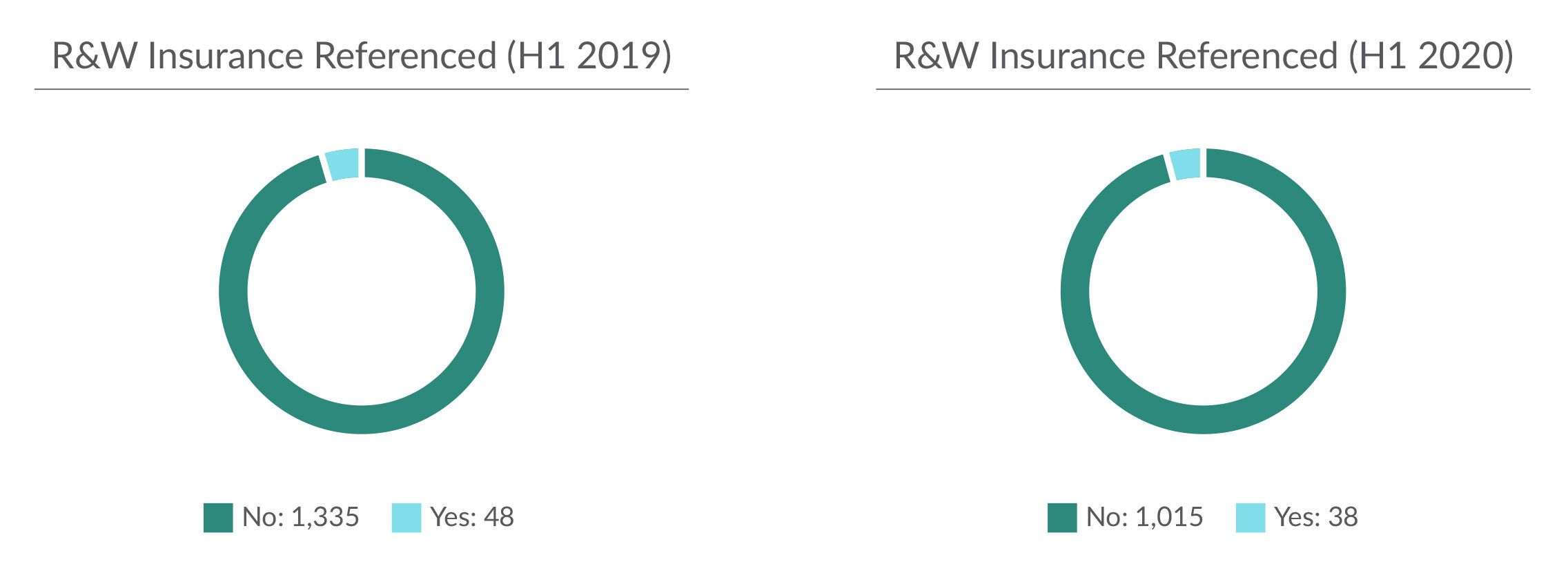

According to a recent study in 2018 to 2019 52 of private company transaction agreements referred to RWI up from only 29 in 2016 to 2017. Reps Warranties insurance is a complex and fast growing marketplace.

W I Insurance Policy A Sophisticated Tool For The Benefit Of Both The Seller And The Buyer Portolano Cavallo

Thus a reps and warranties insurance policy with a 20 million limit of liability on a moderately complicated deal might cost approximately 650000.

Reps and warranties insurance policy. Related Materials Available for both buyers and sellers in a transaction this policy provides protection against financial losses including costs associated with defending claims for certain unintentional and unknown breaches of the sellers representations and warranties made in. A typical RWI policy offers limits of 10-20 of deal value a deductible of 1 of deal value and premiums of 2-3 of limits. In its basic form RW insurance covers breaches by the seller or target of their respective representations and warranties in the acquisition agreement up to a policy limit.

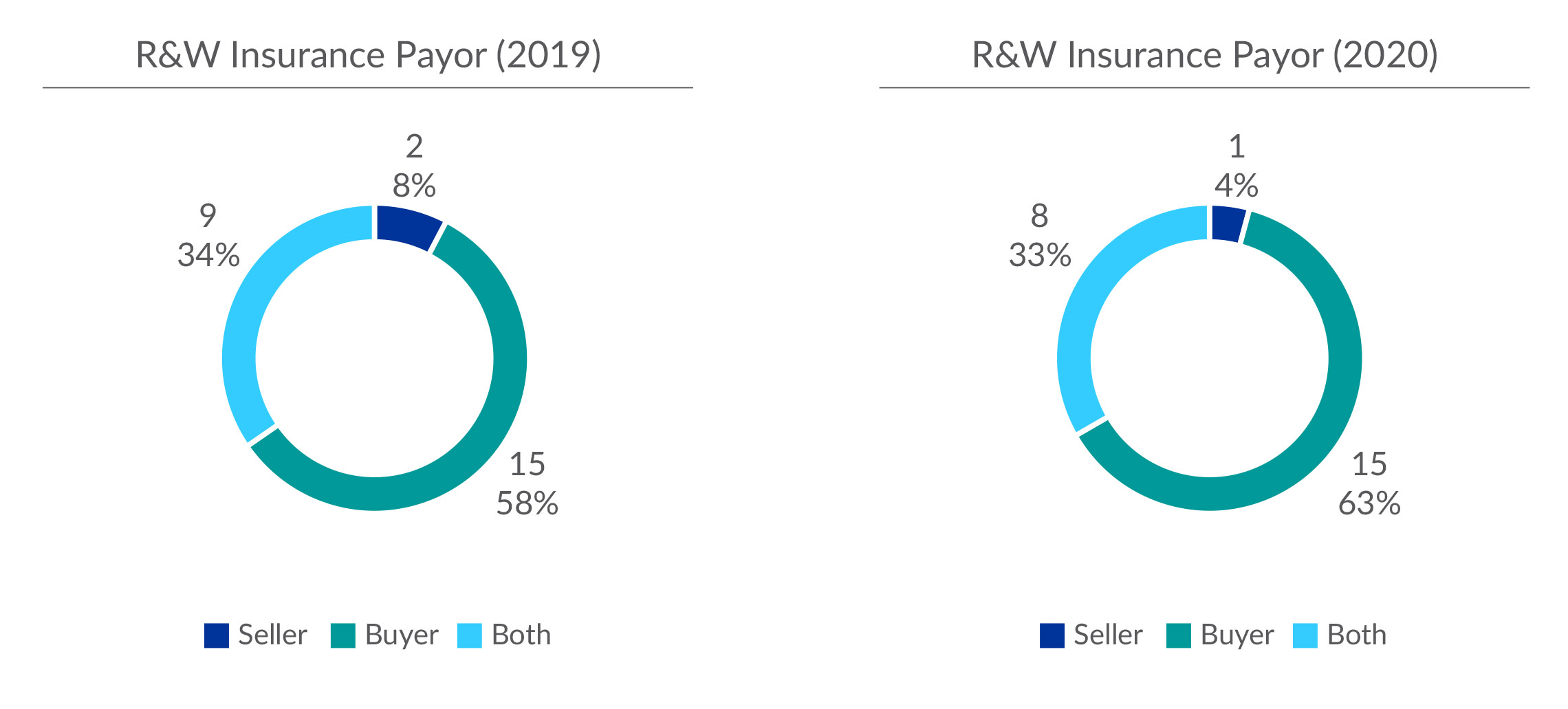

The policy may insure the seller or the buyer. Reps and warranties insurance is essentially breach of contract cover designed to enhance or replace the indemnification given by the seller to the buyer. If you researched this coverage in the past and found it too expensive things have changed.

What are representations in a contract. Representations and warranties insurance should be part of any large-scale merger or acquisition deal. While Reps Warranties Insurance is not a standard practice in all MA transactions the insurance product is being utilize more and morefor good reason.

What is representation and warranty insurance. It requires a dedicated insurance broker who understands not only this type of coverage but is backed by the resources to handle all the in-surance lines and questions that come out of a transaction. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due.

In terms of coverage and cost. Now Reps Warranties Insurance is being used in lieu of the indemnity agreements that require escrowed funds. As one of the fastest growing segments of the insurance industry representations warranties coverage insures loss caused by a misrepresentation made to a buyer of a business.

Reps and Warranties Insurance provides benefits to both buyers and sellers. RWI policies are designed to cover only risks that are unknown at the time of contracting and to exclude risks that are known by the transacting parties or their representatives. Under a buy-side representations and warranties insurance RWI policy the buyer in an MA transaction recovers directly from an insurer for losses arising from certain breaches of the sellers representations and warranties in the acquisition agreement.

Questions or Comments About This Guide. Recent years have witnessed a surge in the number of MA deals that use representations and warranties insurance RWI. A common question among clients in 2019-2020 focused on how to approach the costs of retention in a representations and warranties insurance policy.

Representation and Warranty Insurance Representation Warranty Insurance RW Insurance is a type of insurance policy purchased in connection with corporate transactions and covers the indemnification for certain breaches of the representations and warranties in the transaction agreements. When seeking out an RWI policy aside from carefully reviewing the extent of the coverage the insured needs to consider the costs of the premium and the costs and structure of the retention. The robust and competitive MA market has led to an increase in representation and warranty insurance RWI policies which has transformed the MA process.

Such a policy puts the risk in a business transaction away from buyer and seller and onto a third party an insurance company. Reps and warranties insurance is a contract between the buyer or seller and an insurance company whereby the insurance company will indemnify for losses resulting from a breach of reps and warrants. What Is Representations and Warranties Insurance.

RW insurance is typically procured by the buyer with the buyer being the insured party under the policy. Since proceeds from a reps and warranties policy may result in net taxable income to the buyer a tax gross-up feature may be available for additional premium.

8 Things To Know About Reps Warranties Insurance Rwi Diversified Insurance Group

Representations And Warranties Insurance Claim Study Aon

W I Insurance Policy A Sophisticated Tool For The Benefit Of Both The Seller And The Buyer Portolano Cavallo

Reps And Warranties Insurance In Latin America Jones Day

Market Trends Representations And Warranties Insurance

Reps Warranties Ins What Dealmakers Should Know Rob Freeman

Understanding Warranty In Insurance

The Value Of Reps Warranties Insurance A Comprehensive Review Going Into 2019 Risk Insurance

Https Woodruffsawyer Com Wp Content Uploads 2018 09 Ws Repswarranties Insurance Guide 9 4 Pdf

Market Trends Representations And Warranties Insurance

Commercial General Liability Insurance Policy

Types Of Insurance Plans Arkansas Blue Cross And Blue Shield

Representations And Warranties Insurance Claim Study Aon

Platinum Auto Warranty Bumper Repair Excellence Quotes Auto Insurance Quotes

Representations And Warranties Insurance Claim Study Aon

Https Www Gibsondunn Com Wp Content Uploads 2019 05 Webcastslides Insuring The Deal Key Considerations When Utilizing Transactional Insurance 15 May 2019 Pdf

Https Www Morganlewis Com Media Files Document 2019 Ma Academy Third Party Representations And Warranties Insurance In Strategic And Pe Deals Ppt Final Pdf

Https Www Mayerbrown Com Media Files Perspectives Events Publications 2020 10 The Rise Of Reps And Warranties Insurance In Upstream Ma Pdf

Post a Comment for "Reps And Warranties Insurance Policy"