Renters Insurance Deductible Meaning

Learn here how deductibles work and how to choose one. If some of the loss was subject to limitations this would then be applied and could further reduce the adjusted claim.

Do You Know What Does Renters Insurance Cover Infographic Rentersinsurance Renters Insurance Renter Funny Motivation

The amount of your deductible is often tied to your policys premium the amount you pay your insurance company to keep your policy in force.

Renters insurance deductible meaning. When you file a renters insurance claim you may be responsible for paying your deductible which is your share of a covered claim. Your deductible and premium are listed in your policy and. What is Excess Insurance or Excess Deductible for Rental Cars.

Enter the renters insurance deductible. In other words its the amount of money that you spend out-of-pocket before the policy kicks in and covers the rest of the loss up to the policy limit. This means that if something happens to the car you are liable to pay a charge to access your insurance.

Its important to know what those terms mean and how they come into play if you need to file a claim. Renters insurance also covers your liability if someone gets injured in your home. The higher your deductible the more of the repair or claim cost.

You have a 500 deductible and a fire damages your 2000 couch. See more on how your renters insurance deductible works. You pay the deductible first and then the insurance company steps in to pay the remainder of the cost of the claim.

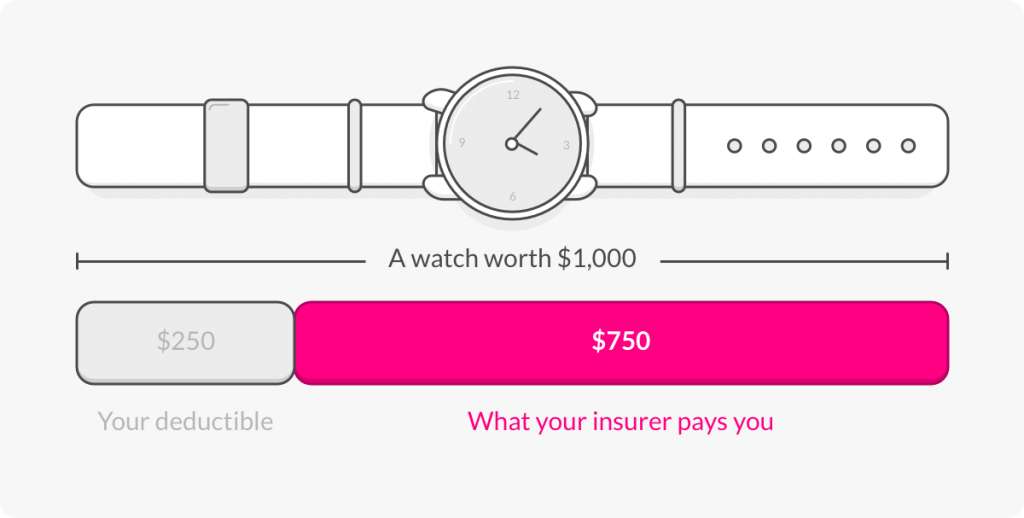

A deductible is the amount of money you will pay out of pocket when you make a claim on your renters insurance policy. Viewed another way its the amount that is subtracted from the. The amount that you the insured have to pay out of pocket towards an insured loss before your insurance company pays anything on a claim.

Also typically excluded are. Its available to persons. What renters insurance wont cover.

A higher renters insurance deductible will lower the price of regular payments to your insurer but will obligate you to pay a larger share of your claims. For example if your loss include 20000 in firearms and your policy had a limit of 2000 the settlement would be reduced an additional 18000. The company would reimburse you for 49000 if your deductible was 1000.

Most renters insurance coverages include a deductible and all coverages are subject to limits. Selecting the appropriate deductible for your renters insurance requires striking a balance between what youre. Your deductible is what you pay out of your own pocket to repair your home or for another claim.

The most common deductible chosen by policyholders is 500. Your policy will include a deductible which is the amount you have to pay if you have a claim separate from the policy premium. Just as with home insurance policies renters insurance wont cover damage from earth movement That movement includes earthquakes mudslides and landslides.

Neglect meaning your failure to save your property at the time of loss or after. In an insurance policy the deductible in British English the excess is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments.

Whenever you file a renters insurance claim your insurer typically subtracts a deductible from the claim payout amount. Higher deductibles lower renters insurance cost but increase the amount of a covered loss you must bear. You choose your deductible amount which typically ranges from 250 2500 for renters and 500 and upwards for homeowners.

A deductible is the amount you are responsible for paying out of pocket in the case of a claim. Renters insurance is financial protection against the possibility that youll get robbed or your belongings will be destroyed or lost in some kind of peril. Youll typically find that the lower your premium the more your deductible may be for each covered loss.

Before renters insurance helps pay for a covered loss youll likely need to pay a deductible. Making a renters insurance claim often means paying a deductible. What is a renters insurance deductible.

A lot of insurance companies include an excess or deductible with their insurance policy. That means if you have a 1000 deductible and 3000 in damageyou pay 1000 and your insurer pays the rest. Renters insurance is property insurance that provides coverage for a policyholders belongings liabilities and possibly living expenses in case of a loss event.

Sometimes the peril that destroys your stuff is so devastating that you have to actually leave your home and live somewhere else temporarily. A deductible is an amount of money you choose when purchasing a policy that will be subtracted from any future claims payouts. What is a renters or homeowners insurance deductible.

Youll pay 500 and your insurer will pay the remaining 1500. What is a renters insurance deductible Renters insurance covers your stuff but you also have some responsibility for your possessions. A renters insurance deductible is the amount of risk that you retain and do not transfer to the insurance company youve purchased the policy from.

The renters insurance deductible is the portion of a property loss that you the policy holder will be responsible for when you have a claim.

Renters Ho4 Insurance Lemonade Com

What Is A Homeowners Insurance Deductible Valuepenguin

What S An Insurance Deductible Insurance Deductible Insurance Car Insurance

What Is A Homeowners Insurance Deductible Valuepenguin

Renters Insurance Deductible Explained Mig Insurance

Absorbing The Deductible How Deductibles Work In Florida Property Insurance Claims Vip Adjusting

Deductible Insurance What Does Deductible Mean

What Is An Insurance Deductible And How Does It Affect You

Request Our Guide To Understanding Your Insurance Co Insurance Health Insurance Health Information Management

How Do Insurance Deductibles Work Lemonade Blog

Understanding Renters Insurance Deductibles Quotewizard

Renters Insurance Deductible Explained Mig Insurance

Choosing A Renters Insurance Deductible Valuepenguin

Difference Between High And Low Insurance Deductibles

How Do Insurance Deductibles Work Lemonade Blog

How Do Insurance Deductibles Work Lemonade Blog

Post a Comment for "Renters Insurance Deductible Meaning"