Product Liability Insurance Cost Meaning

What is Covered with Product Liability Insurance. Manufacturing defects are claims related to problems that occurred while the product was being created or assembled.

Professional Liability Insurance Benefits Professionalliabilityinsurance Insurance Insurance Benefits Liability Insurance

Some typical case studies of product liability insurance include.

Product liability insurance cost meaning. Design defects are claims related to the product issues that were present even before it was made. You may have a business that manufactures a hazardous product because of this it may be harder for you to get product liability insurance. Using a specialty insurer can help you to get this type of insurance.

In certain situations you may be liable even if you havent actually manufactured the product. Product liability insurance is a type of business insurance that can cover the cost of compensation claims if someone is injured or their property is damaged by a product that youve sold. What Is Product Liability Insurance.

Product Liability Insurance protection against financial loss arising out of the legal liability incurred by an insured because of injury or damage resulting from the use of a covered product or out of the liability incurred by a contractor after a job is completed completed operations cover. At that point you might as well start packing up and fixing to. Policies will cover any damage that the product causes as well as injuries sustained both directly or indirectly.

Product liability insurance concerns the products a company offers specifically the way those products impact both clients and third parties. 73 Any Product which the Insured knew or ought to have known was intended for. Product liability insurance can help mitigate the losses from these types of situations.

Product Liability Insurance covers the legal and court costs of defending any claims of bodily injury property damage or financial losses caused by your product. Or product liability claims which Intercell may incur as a result of the use of its product candidates in clinical trials or the sale of products or may cease to be available at a reasonable cost in the future. What does product liability insurance cover.

Product liability insurance is insurance for a producer or supplier of goods against injury to third parties or loss of or damage to their property that is caused by a fault in the goods. Usually not only will such recall cost you a huge amount of money but it. Product Liability insurance is intended to cover any compensation payable to a third party and your defence costs the se are the reasonable costs incurred while investigating and defending a covered claim including legal fees experts fees and court costs.

Product liability insurance protects against claims for personal injury or property damage caused by a product your business designed sold or supplied. For most small business owners a claim like this without proper insurance is catastrophic. Product Liability Costs means costs associated with Product Liability Claims resulting from the Development Manufacture Commercialization or use of the Licensed Products under this Agreement in the United States and product liability insurance premiums for policies covering the Development Manufacture Commercialization or use of the Licensed Products in the United States other than.

What is Product Liability Insurance. For example if you sell a toy that causes injury because of a fault product liability insurance can cover the resulting claim. What Is Product Liability Insurance.

Using a surplus lines broker helps you to find this kind of insurer. Product Liability Insurance Costs. If one of those products is faulty or causes some sort of injury your business could be held accountable for the consequences that follow.

It covers liability for compensatory costs legal fees and any other costs associated with the case. 72 The recall of any Product or any part thereof. Product Liability Insurance is a way of protecting your business from financial loss due to legal and court costs brought on by a potential suit by one of your customers.

What is product liability insurance. Typically product liability claims arise from design defects manufacturing defects warning or use defects and strict liability. There are multiple reasons for a product recall like tampering contamination or a design flaw.

Product Liability insurance is there to help you from the moment an allegation of negligence relating to your product is made. If a customer decides to sue you because your product caused bodily injuries or property damage a product liability policy will pay for legal costs which can go up to 4 billion. As a business owner youre responsible for every product you make and sell.

Product liability insurance protects your business should a customer incur damages as a result of a fault with the product you have provided them with. The average cost of a product liability case in the US is just over 5 million dollars. 71 Costs of Remedying Defective Product- The policy excludes liability for costs in the repair reconditioning modification or replacement of any part of any product which is or is alleged to be defective.

How much youre charged for liability insurance depends on the type of product. Being in the business of producing products is facing with a risk for a recall. Product insurance is there to help you cover the financial losses caused by your product.

Product liability insurance is a type of coverage that provides protection for the manufacturer seller and. That said you will be protected in case of.

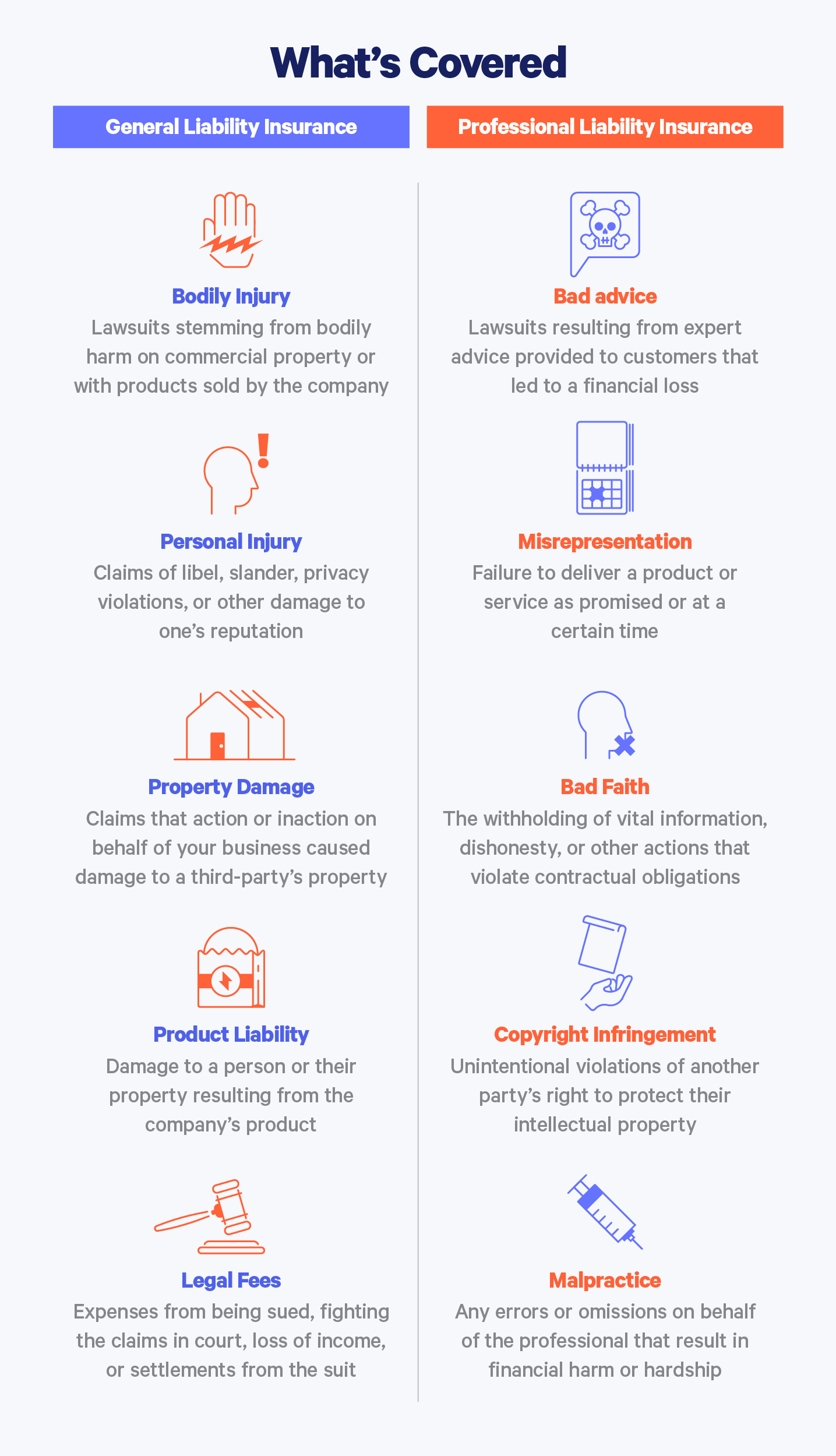

General Liability Vs Professional Liability Insurance Coverage Embroker

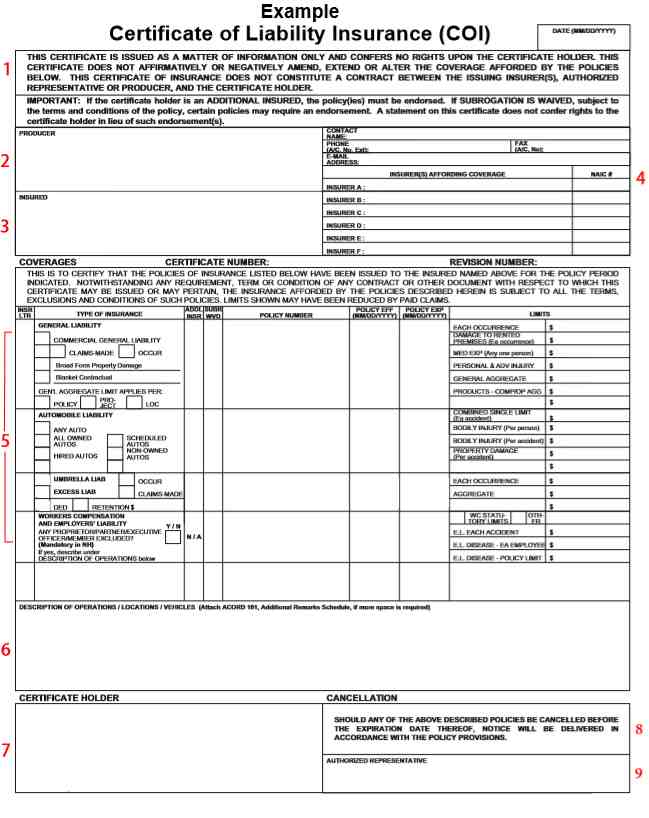

Understanding Your Certificate Of Insurance Harry Levine Insurance

3 Things Your Products Need To Succeed In The Market

Product Liability Insurance Cost Coverage Quotes Embroker

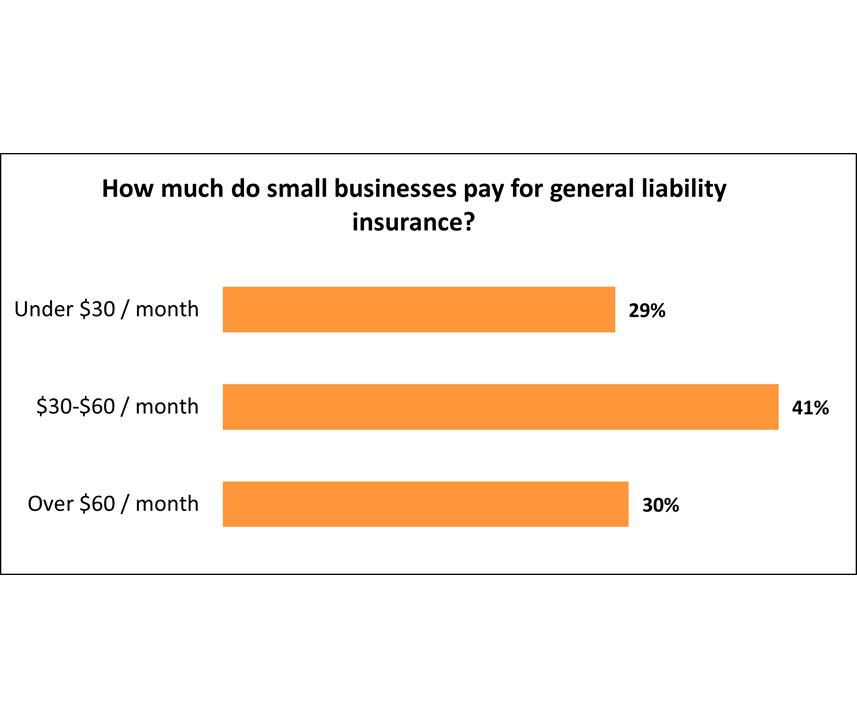

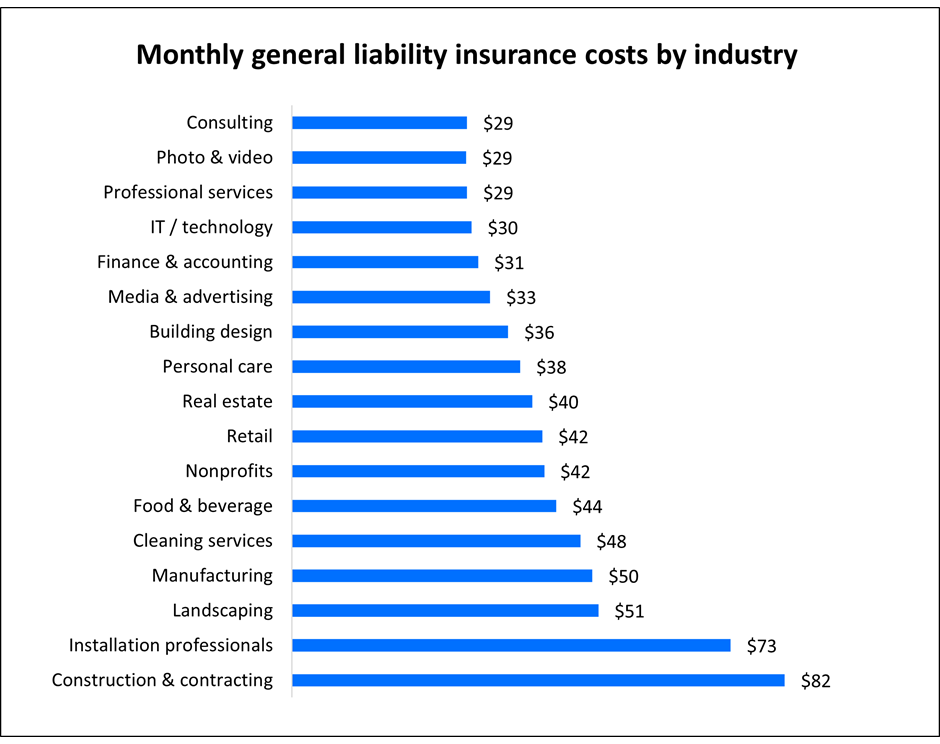

General Liability Insurance Cost Insureon

Product Liability Insurance Cost Quotes Coverage Advisorsmith

Product Liability Insurance Protects Businesses In The Event That Some Defect In Their Product Causes Bodi Liability Insurance Business Risk Business Insurance

General Liability Vs Professional Liability Insurance Coverage Embroker

General Liability Insurance Cost Insureon

Product Liability Insurance Cost Quotes Coverage Advisorsmith

General Liability Vs Professional Liability Insurance Coverage Embroker

Public Liability And Property Damage Insurance Cost In India Business Insurance Small Business Insurance Liability

Certificate Of Liability Insurance What It Is How To Request One

Does Your Business Need Commercial General Public Liability Insurance In 2021 Commercial General Liability Liability Insurance Commercial

How Are General Liability Insurance Premiums Calculated Insureon

What Is Non Trucking Liability Insurance

General Liability Vs Professional Liability Insurance Coverage Embroker

General Liability Vs Professional Liability Insurance Coverage Embroker

Errors And Omissions Insurance Policy In India Small Business Insurance Insurance Policy Business Insurance

Post a Comment for "Product Liability Insurance Cost Meaning"