S Corp Health Insurance Not On W2

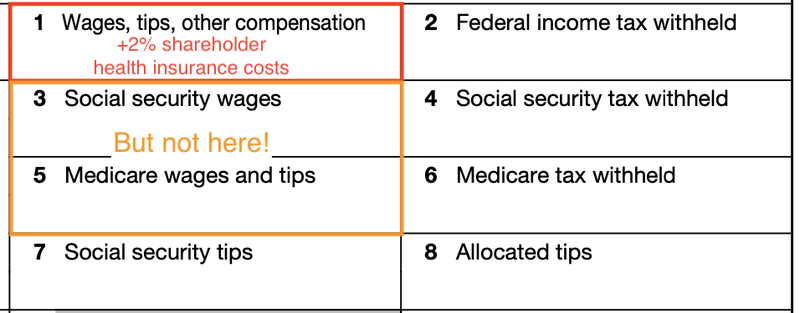

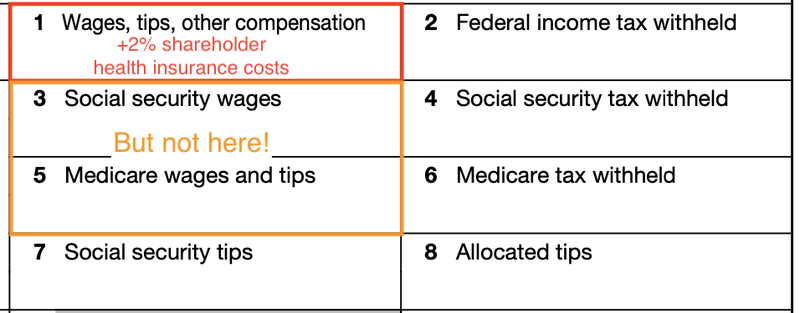

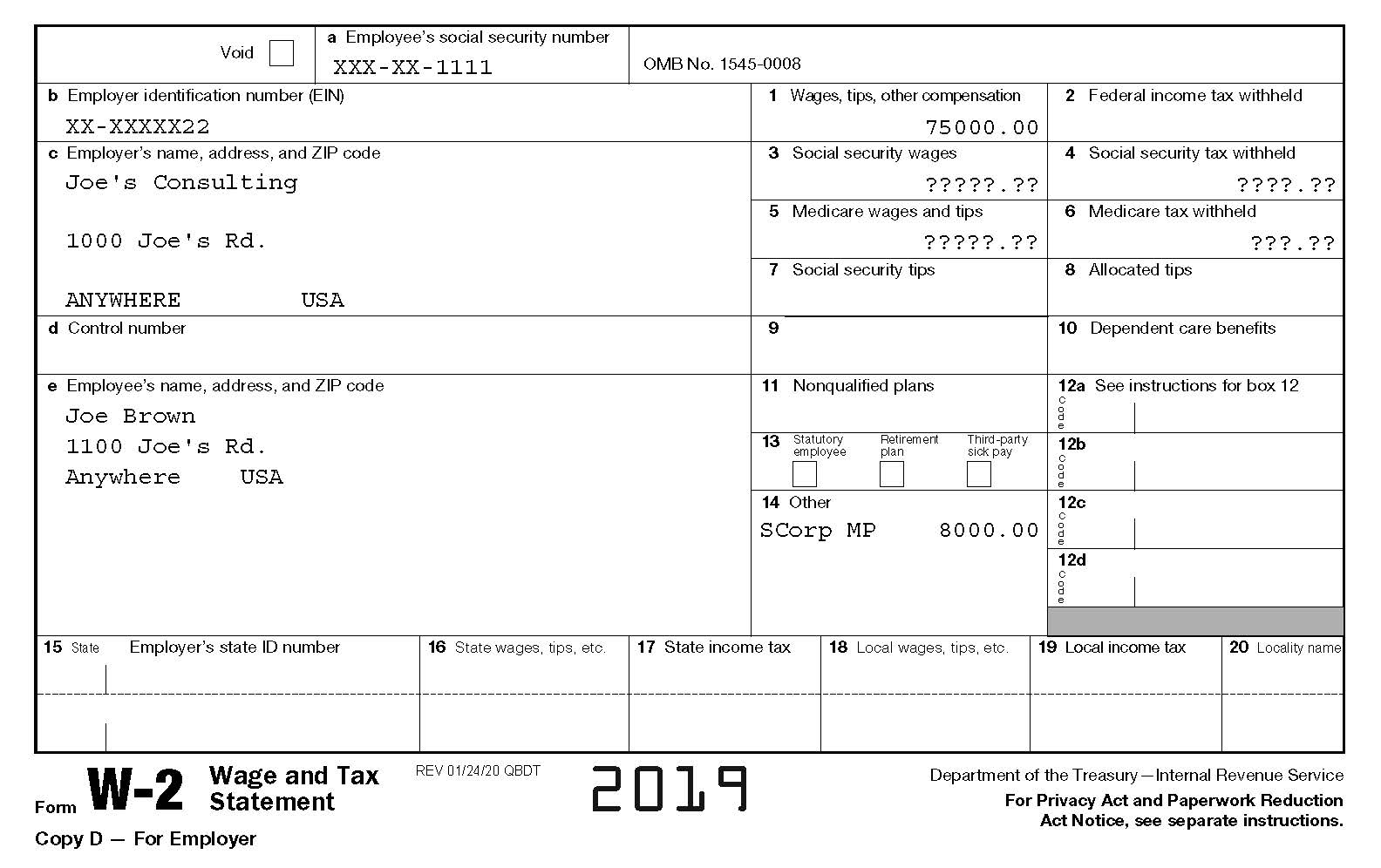

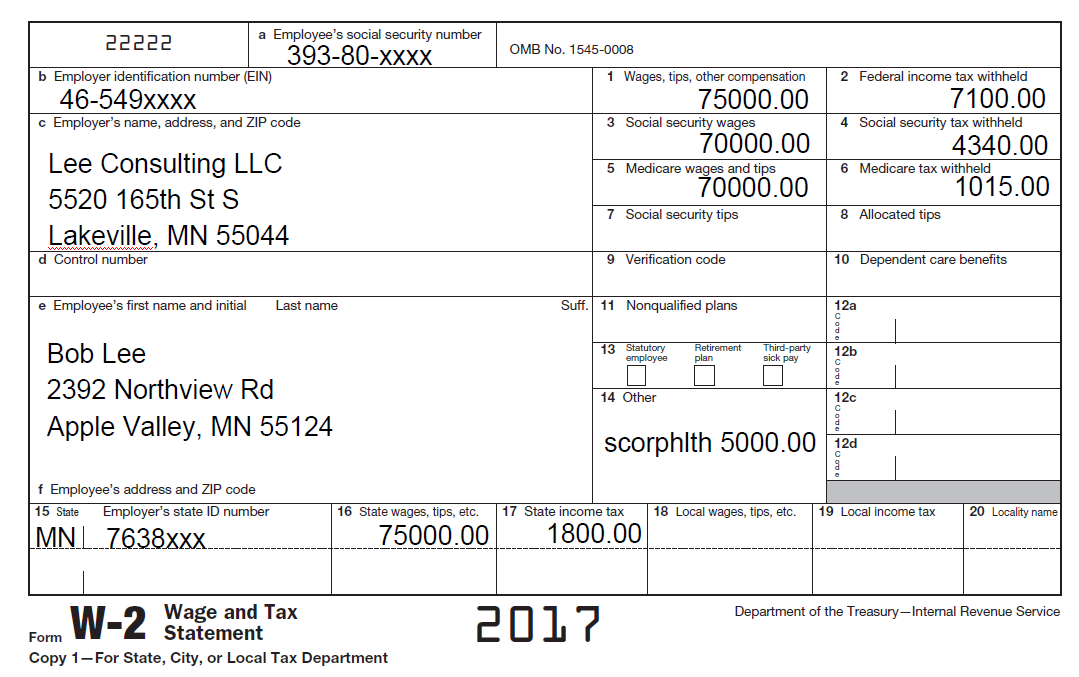

A more than 2 shareholder of an S corporation is not eligible for this exclusion. The premiums are NOT included in Boxes 3 and 5 of Form W-2 and are not subject to Social Security or Medicare FICA or Unemployment FUTA taxes.

Solved How To Add S Corp Owner S Health And Life Insurance To Wages

Theres no standard list of W-2 codes for Box 14 so employers can list any description they choose for 2 health premiums including SCORP SEHLTH INS etc.

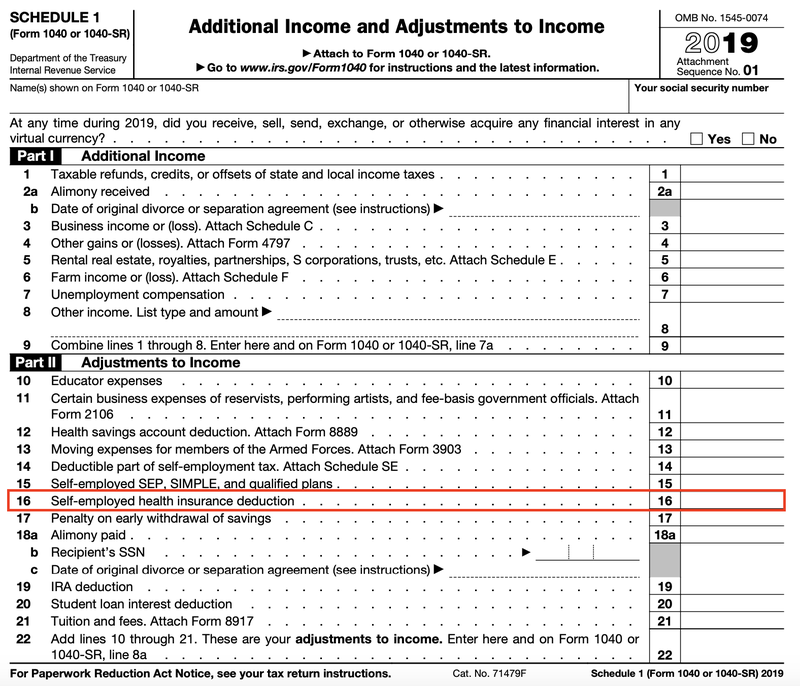

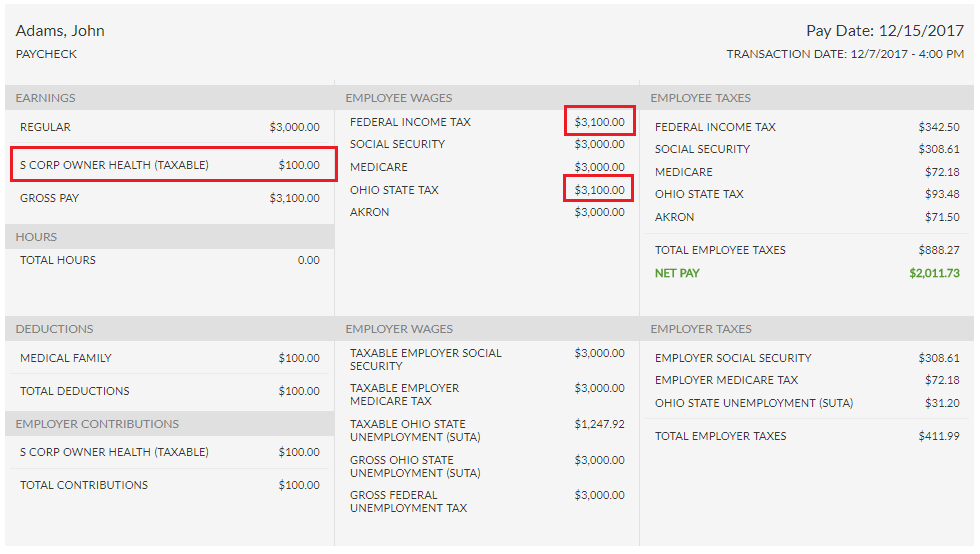

S corp health insurance not on w2. Health and accident insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation and reportable as wages on the shareholder-employees Form W-2 subject to income tax withholding. S Corporation Compensation and Medical Insurance Issues. The main benefit the shareholderemployee receives from reporting the insurance premiums on his or her W-2 is the option to take the health insurance premiums as a deduction to gross income on line 29 of page one of the shareholders 1040.

You can read more about this here. The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14 S. You obtain an accident and health insurance policy in your own name to cover you and your family.

The premiums the business paid can be deducted on your Form 1040 line 29 and as a business expense on Form 1120S. Your health insurance premiums paid by your business are included in your gross wages on your W-2. It also doesnt include money in health savings accounts and it isnt required to include amounts spent on.

Where are health insurance premiums on w2. S-Corp to include the health insurance premiums in the 2 shareholder-employees W-2 Box 1 wages but not Box 3 SS wages and Box 5 Medicare wages. The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14 S.

As we come to the close of another year we wanted to make you aware of the tax law concerning the proper treatment of health insurance premiums qualified long-term care insurance premiums and short- and long-term disability premium payments. - Applicable For Foreign Citizens Only - Not for Local citizens students. Annons Health Insurance Plans Designed for Expats Living Working in Sweden.

Add health insurance costs to gross wages on your W-2 S corporation owners who participate in management are considered employees which means theyre issued a W-2 every January. If a more than 2 percent shareholder fails to include their health insurance premiums on their W-2 technically the IRS will not allow the self-employed health insurance deduction on the individual return and the shareholder would have to claim the premiums as a medical expense on Schedule A which unfortunately is subject to a haircut of 75 of adjusted gross income 10 starting in 2013. - Applicable For Foreign Citizens Only - Not for Local citizens students.

This rule also applies to the health insurance paid on behalf of your parents spouse children or grandchildren who are working for your S Corporation even if they are not shareholders of the corporation. Annons Health Insurance Plans Designed for Expats Living Working in Sweden. Even though the tax law has been in effect for.

S-Corp to include the health insurance premiums on Form 1120S Line 7 Officer compensation. Medicare tax withheld on your W-2. Annons Compare 50 Health Insurance Plans Designed for Expatriates.

To enter the Officer Health Insurance on the Schedule K-1 box 17. The health insurance could be entered on the Schedule K-1 box 17 and an adjustment for Expenses on books not on Schedule K entered on the Schedule M-1. Health Insurance for S Corporation 2 Shareholders The cost of health insurance premiums paid by an employer is usually excluded from taxable income on the employees W-2.

Select the affected Shareholder name at the top of the left hand column. Get a Free Quote. The cost of the premiums paid on their behalf must also be included in wages on their Form W-2 in Box 1 and Box 14.

Annons Compare 50 Health Insurance Plans Designed for Expatriates. 2 shareholder-employee to claim the self-employed health insurance deduction. Go go Screen 33 Schedule K-1 Overrides.

The health insurance premiums paid by the S corporation are reported on Form W-2 Box 14. S-Corp Medical Insurance Update. Get a Free Quote.

In W-2 box one.

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance

Tax Blog Why Blu Tax Accounting

I Own An S Corp How Do I Get Paid Clearpath Advisors

Http Www Islandcpas Com Uploads S 20corp 20health 20ins 20fact 20sheet 20 20web 20version Pdf

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is 2 Shareholder Health Insurance Definition Benefits

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

Taxability Of S Corp Health Premiums Included In Salary Cpa Certified Public Accountant Income Taxes Accounting Services Gary Boyd Cpa

Amazing Way To Take Health Insurance As A Tax Deduction

Health Insurance And W 2 Reporting For Shareholders Of S Corporationsgranite Payroll

How Do I Enter An Amount For S Corp Health Insurance Premiums Paid In Box 14 On 1 W2 In Quickbooks Online

S Corp Shareholder Employee Health Premium Tracking

Tax Blog Why Blu Tax Accounting

How To Deduct Shareholder Health Insurance For S Corporations Amy Northard Cpa The Accountant For Creatives

A Beginner S Guide To S Corp Health Insurance The Blueprint

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Post a Comment for "S Corp Health Insurance Not On W2"