Is S Corp Owners Health Insurance Taxable

The amount is subject to income taxes but not employment taxes. Owneremployees - Except for salaried owneremployees health insurance paid by a business on behalf of a self-employed person is not a deductible business expense.

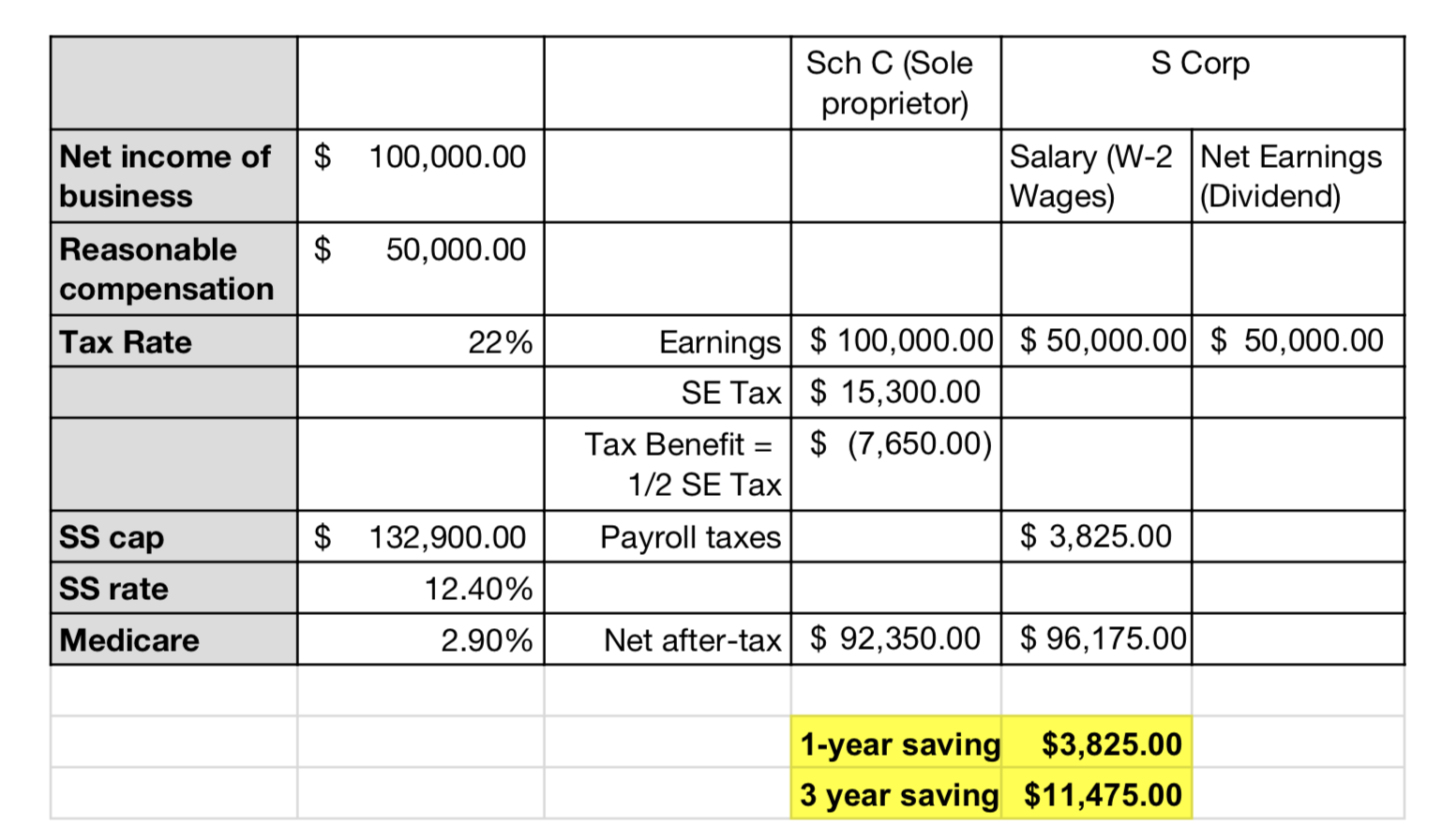

Advantages And Responsibilities Of An S Corp

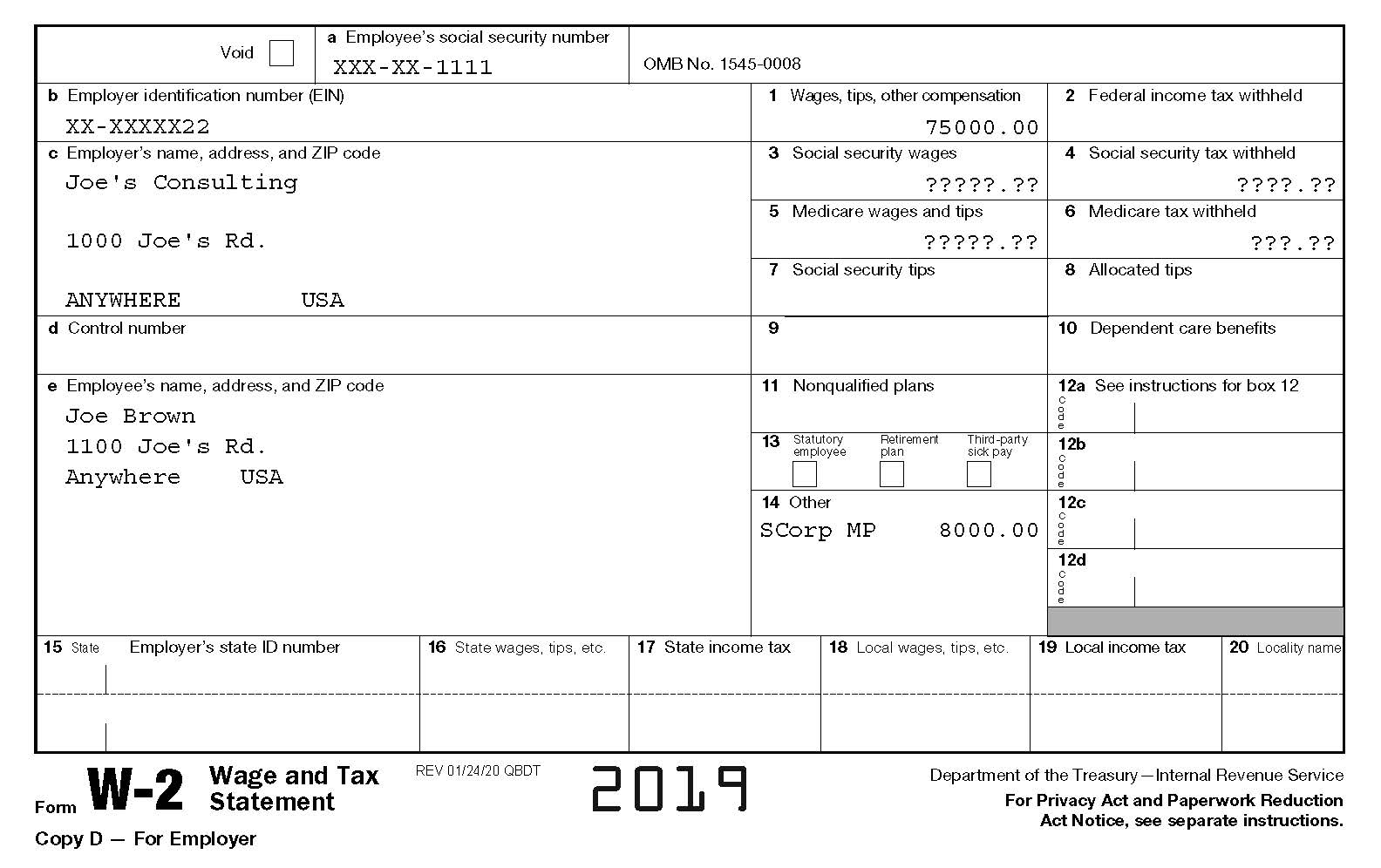

1 SCorp deducts owners medical insurance cost as employee medical.

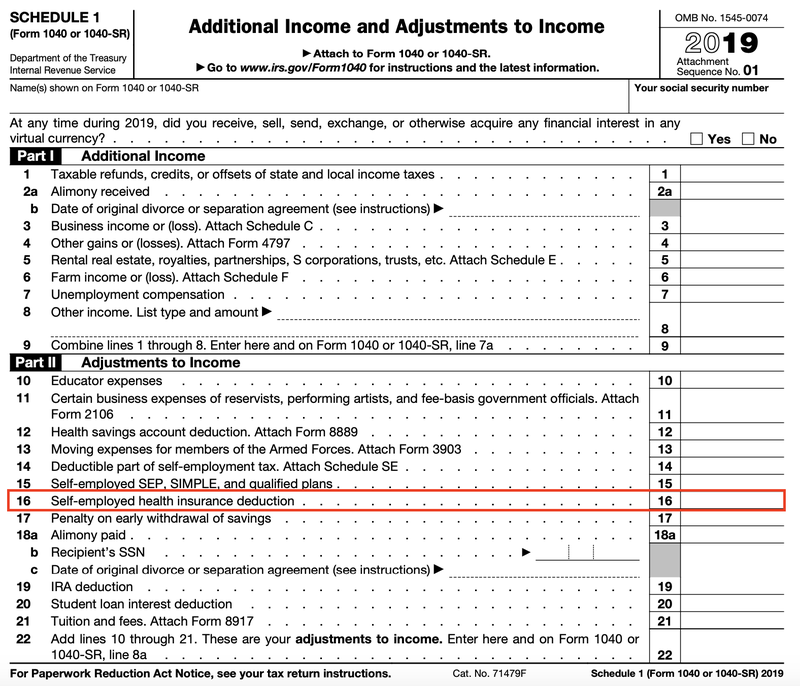

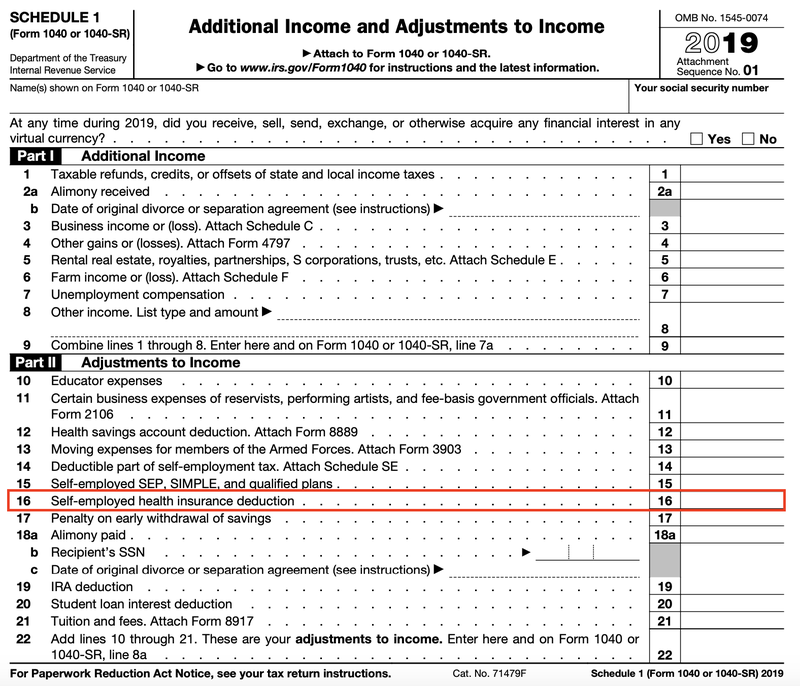

Is s corp owners health insurance taxable. However such payments are not subject to Social Security and Medicare taxes if 1 youre the only employee of your S corporation or 2 your corporation has other non-owner employees and provides them with health insurance. You must include the amount of the S Corp shareholder health insurance premium in the employees taxable wages. Deduct as an individual taxpayer the cost of the premiums using the self-employed health insurance deduction on page 1 of your Form 1040.

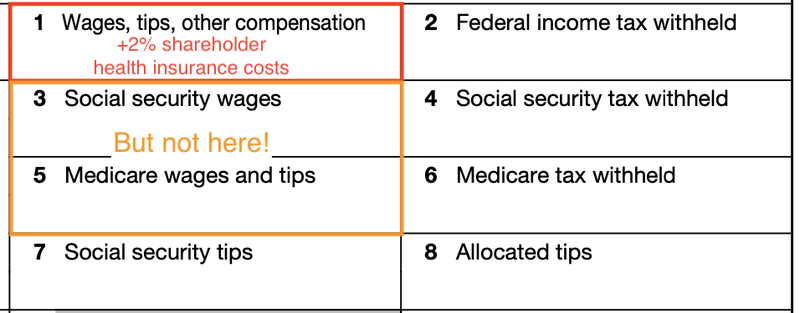

1 Information downloaded from. To set up benefits for 2 shareholder employees. Treatment by S corporation Properly treated as wages to the 2-percent shareholder-employee the S corporation deducts the premiums paid as compensation expense on Form 1120S.

For S-Corp or LLC companies the IRS requires that health insurance premiums paid by the company to employees with a greater than 2 ownership be reported as wages not pre-tax benefits and included on their W2s. S corporations are pass-through entities that although they are corporations for other purposes are generally taxed similarly to partnerships. 5 Shareholder subtracts it on 1040 page 1 as self employed insurance.

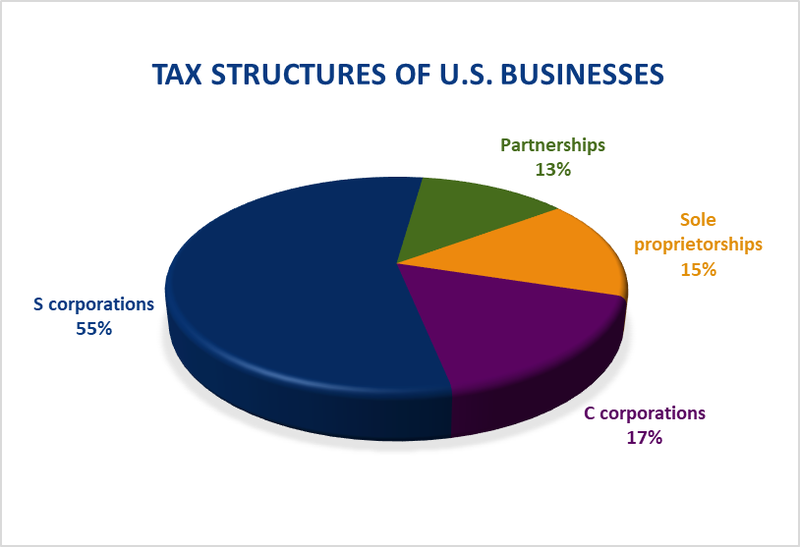

How to Deduct Shareholder Health Insurance for S Corporations. Just like other business structures S corporations can offer health insurance premium coverage for their non-owner employees as a tax-free fringe benefit. S corps have complicated issues with health insurance premiums paid for.

In other words the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholders salary. 2 SCorp adds it to wages on 941 but not to SS or Medicare. And the premium amounts are taxable for your employees.

Health Insurance Employee Benefit for a S Corporation. One drawback to the S corporation is that employeeowners cannot deduct the cost of health insurance from taxes. This deduction is only allowed if the health insurance premiums are reported as taxable compensation in the wages of the 2-percent shareholder-employees Form W-2.

Owners below 2 are not eligible for the self employed medical insurance deduction. 4 SCorp subtracts it on 940 line 4 as an exempt payment. While an S corp has pass through taxation like many other forms of tax elections in respect to health insurance premiums the law gets more complex.

The cost of health insurance premiums paid by the S corporation for a 2 shareholder is included in the shareholders W-2 as Box 1 taxable income. For more information review Notice 2008-1 from the IRS. You must pay income tax on the health insurance premium payments made by your S corporation.

The bottom line is that in order for a shareholder to claim an above-the-line deduction the health insurance premiums must ultimately be paid by the S corporation and must be reported as taxable compensation in the shareholders W-2. Insurance S Corp Owners Health Insurance Taxable On September 27 2020 by. You can also provide health insurance to any.

There is good news though. The corporation deducts the expense as compensation and includes the amount on the shareholders W-2. For Pennsylvania personal income tax purposes if the health plan is non-discriminatory regardless of the percentage of the shareholder it is not included in the shareholder wages and is deductible for the S corporation.

For example if an S-corporation that pays for health insurance for its non-salaried owneremployee this expense is not listed as a business expense on the Form 1120 but rather the. If you provide health insurance to employees who own more than 2 of stock in your S Corp the premiums are tax deductible for your company. These rules only apply to shareholders who own more than 2 of the company.

3 SCorp adds it to wages on W2 but not to SS or Medicare so that 941s and W3 will reconcile. Have the S corporation include the health insurance as wages not subject to FICA on your W-2. Then the money paid for your insurance is considered taxable income.

A special rule applies for the deductibility of accident and health ie medical insurance paid by an S-corp. The s corporations payment for health insurance is not eligible for additional forgiveness for s corporation employees who have a 2 percent or more stake. You do not have to pay Medicare tax unemployment tax or Social Security on the money your business pays for your health insurance.

The employee doesnt get. 1 No Section 125 plan.

A Beginner S Guide To S Corp Health Insurance The Blueprint

Https Support Businessasap Com Article 261 S Corporation Officer Health Insurance

Fringe Benefits For More Than 2 Shareholders Of An S Corporation Benefit Minute

What Is 2 Shareholder Health Insurance Definition Benefits

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

A Beginner S Guide To S Corp Health Insurance The Blueprint

Common Fringe Benefits Rules For 2 S Corp Shareholders And Changes Under The Cares Act

S Corp Vs C Corp Which Is Right For Your Small Business The Blueprint

S Corp Vs C Corp Which Is Right For Your Small Business The Blueprint

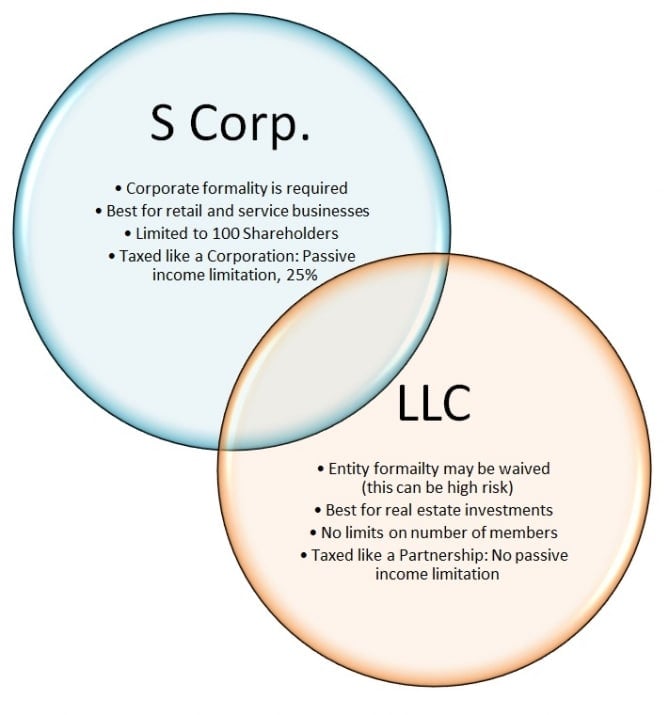

Llc Vs S Corp What S The Difference Truic

A Beginner S Guide To S Corp Health Insurance The Blueprint

How To Deduct Your Health Insurance As A 2 Shareholder Hourly Inc

How To Deduct Shareholder Health Insurance For S Corporations Amy Northard Cpa The Accountant For Creatives

A Beginner S Guide To S Corporation Taxes The Blueprint

I Own An S Corp How Do I Get Paid Clearpath Advisors

S Corp Election Self Employment S Corporation Taxes Wcg Cpas

Taxability Of S Corp Health Premiums Included In Salary Cpa Certified Public Accountant Income Taxes Accounting Services Gary Boyd Cpa

Post a Comment for "Is S Corp Owners Health Insurance Taxable"